A number of people have been emailing me and asking me about trends in specific areas, and although I sincerely wish I had the time to cover more areas, I just can't do it. Los Angeles County housing bubble watchers can certainly use more regional bloggers! Anybody out there willing to step up to the plate?!? Are you committed? Will you be able to blog through sun and snow and sleet and hail?

In the hopes of inspiring more of you to blog about your local housing bubbles, I thought I would post on what tools I use to track housing market trends in my area.

The #1 tool is your two legs. Walk around your neighborhood and start collecting real estate brochures. Did you know we've been doing this since we moved to Redondo Beach from Gardena in 1995? Yes, believe it. We thought the market was "a tad pricey" then, well - you know what I think of it now!

But don't do what I did - just throw those real estate flyers in a file drawer. Take them home and write the date on them - then throw them in the file drawer. If you want to set up your own database of market trends, the properties on these flyers will make useful records. In the meantime they give you great anecdotal evidence of what's going on.

And no, it's not too late to get started. We have years of excess to work off.

Take that stack of flyers out occasionally and then look up the addresses on domania.com and see if anything has sold. If it hasn't sold, go to ziprealty.com and see if the asking price has come down. If so, note the new asking price on the flyer. If the property has sold, note the sales price and date on the flyer. If you don't want to go the database route, you can just blog that real estate transaction, if you think it's worth blogging. Include your own photograph.

And this leads to the #2 tool - a camera. A picture is worth 1000 words. This year I purchased a Casio Excelim with one of the purposes being blogging work. It's very slim and fits in the back pocket of my jeans. Keep your camera with you at all times.

I don't normally find the best situations to photograph while I'm walking around looking for them. Rather, I wait for the situations to come to me. When you see something great, photograph it ASAP. Last weekend I photographed a sign in my neighborhood saying home values were dropping. I'm glad I jumped on it because that sign disappeared a few days later. One time I photographed construction in Playa Vista, off the Santa Monica #3 bus. Organize your photographs on your computer in folders labeled by date, so you have a proper timeline.

There are all kinds of things you might be able to photograph. Dilapidated box houses with outrageous asking prices. New McMansions with out of the galaxy asking prices. Construction sites. Signs. Open house flags. Sign twirlers. A house auction. Creative new ways of advertising a house that nobody else has thought of yet.

A scanner can also come in handy. I've scanned pages out of the Learning Annex for their real estate classes, pages out of books, and snail-mailed brochures from the local high-density housing projects in the area, and I've blogged them all.

I would be careful about scanning real estate flyers to post in the blog. When I talk about or photograph specific properties, I like to obscure addresses, license plates, and the names and phone numbers of realtors on signs. I don't want anybody harassed because I posted personal identifying information on this blog.

Pick a few properties that you want to monitor and periodically publish updates on them. Have their listings expired? Have they been relisted? Have the asking prices changed? How was attendance at their open houses?

If there are papers published that are really local to your region, scan them for interesting real estate articles. Recently in my neighborhood there was an episode of Extreme Home Makeover filmed (or whatever it's called). I would have blogged it if I had the time. Almost next door to that house there is another house being remodeled with shipping containers! (That was also written up in the local papers, and I didn't have time to blog it either.) In my view that's an even more interesting story because it says something about what these homeowners value in construction. As it turned out, they were able to cut construction costs by $100 a square foot. Stories about building materials and methods and ways to cut costs for the homeowner will be of future interest, because the standard wasteful bloated construction I see now will probably disappear.

If you did all of the above and nothing else, and did it on a regular basis, you will have a great anecdotal regional housing bubble blog. It would not be a heavy-duty number crunching blog but it would still communicate a great deal. I only wish I had done these things properly starting from 11 years ago! But back then there was no domania.com, and it never dawned on me that there might one day be a way to look up real estate sales online.

If you want a heavier duty number-crunching blog, then a little tech know-how will serve you well. If you want to cover a lot of areas, then you might want to upload the charts to a website and just point the blog to that website, like I do.

To track real estate $$$ volume by zip code, I use melissadata.com, Notepad, Microsoft Excel, and PhotoImpact.

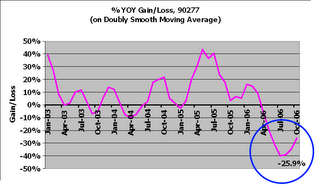

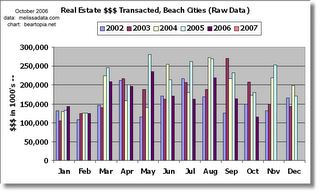

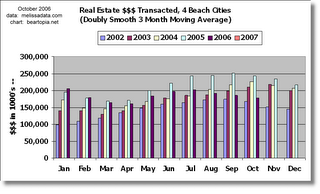

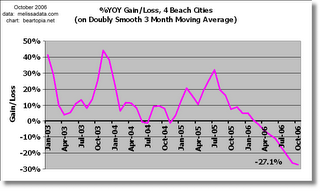

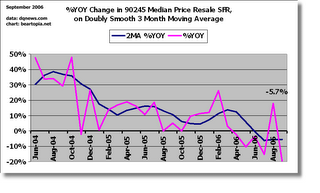

melissadata.com is required for getting historic information. It records total number of sales and average sale price by month for each zip code it tracks. I don't know exactly which zip codes melissadata.com covers so you'll have to find out for yourself. If I wish to cover a particular zip code, I get the data off the page and paste it into Notepad to clean it up. From there, I copy all the data from Notepad and paste it right into an spreadsheet, then I sort it by date so oldest date is on top. Normally it doesn't happen, but make sure there are no skipped months (some low-activity zip codes do have 0 sales for a month). If there is a missing month, I insert a record for that month showing 0 sales. So at this point column A contains the date, column B contains number of sales, and column C contains the average sale price. I put in column D a formula that multiplies B*C. That's the raw total dollar volume. In column E I calculate a simple 3 month moving average of column D. In column F I calculate a 3 month moving average of column E. In column G I do YOY calculations on column F. I then set up one table to show the raw data by year. That will be used to populate the raw column chart. I set up another table to show the doubled moving average by year. That is used to populate the moving average column chart. Then I use the column G YOY calculations to populate the YOY chart.

I copy and paste each chart into PhotoImpact to beautify it a bit, then save each chart out as a PNG (portable network graphic) file.

Since the worksheets are now set up, my work now consists of maintaining it monthly. For this purpose, I need to develop some Excel Visual Basic code, but it will take me a while to figure out - it's been nine years since I've hacked around in Excel VB.

Historical median price data is harder to come by, but it is doable without having to spend money for it. (Well OK, you might have to spend a few dollars for it copying stuff but that's nothing compared to buying individual research reports!) I got very lucky here. One blog reader who had been diligently archiving the monthly DQNews L.A. Times reports in an Excel workbook gave me a copy of her workbook. The only problem for you out-of-the-area visitors is that the data only covers beach cities. If this had not happened, I would have resorted to spending a few Saturdays at a library that microfilms back issues of the L.A. Times. The DQNews data is published in the second half of the month, and in Sunday editions. So you would have to look at maybe 2, at most 3 Sunday editions of the L.A. times per month to find and record your data. Go back as far as you like. If you do this, a laptop might be useful. Otherwise, take good neat readable notes and just enter the data in Excel when you get home. My schedule is packed for the next several months, but when things free up, I might just do this myself to collect much older data. I would really like to go back to 1989.

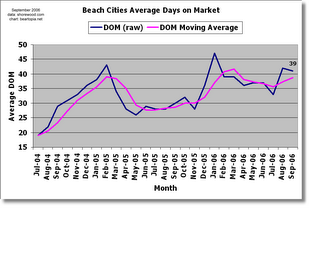

For inventory, sale, and DOM data, check the websites of your local realties and see if they publish that data. I had to rummage around in old news reports of Shorewood to get inventory and sale data for my local area. realtytimes.com might be a good source of information there. Be nice to your local realtors. I think that to survive in that business most realtors have to be genuinely nice people. And it's getting apparent that only the best ones are going to weather what lies ahead. Ask people you know who had a tough time selling their homes but who had realtors that went the extra mile for them. Find a few good realtors with well over a decade of experience behind them, and put links to them on your blog. They might just give you the numbers you are looking for.

My newest data gathering mechanism consists of running Apache server on my home PC along with PHP Admin and MySQL. I am hoping to construct a large enough database that better reflects certain statistics for my city (Redondo Beach). ziprealty.com is one website for finding listings by zip code. catalisthomes.com is another useful website. The open house listings in local papers are also a good data source for constructing records. PHPAdmin makes it pretty easy to enter new records quickly.

I have the database set up so that the full street address makes a unique key. This prevents me from entering duplicates into the database and it helps me spot homes that are getting relisted. So I don't always enter data exactly as I see it presented to me. If a new listing appears for 90278 and I see it's a record I already have in my database, then it's probably a relisting with the asking price reduced. So I keep the original asking price and listing date in the record, and then I fill in special fields for tracking reduced asking price and the date of reduction. This keeps the true time on market more honest, because my records don't "expire."

If that sounds too complicated for you, but you still want a systematic way of keeping records, you can use spreadsheets for that too.

As a special offer, if you start a new blog outside of 90278, 90277, 90266, and 90254 but in Los Angeles County, at minimum following the non heavy-duty number crunching blog suggestions (or improving on them), and post a minimum of two posts a week for 10 weeks, I will send you free the two-volume set Socionomics and Pioneering Studies in Socionomics. These books describe a whole different framework for studying and interpreting the world around us that goes way beyond the conventional analytical methods we learn in school (don't worry, it's not some weird religious cult). They certainly explain why I am a grizzly bear.

In terms of general market performance, 90254 resembles 90277, which I am at least partially covering. I cover 90278. There is a blog for 90266, check my map of housing bubble blogs. But I rarely get through 90245 (El Segundo), which technically is "my" area but it really deserves its own blog.

If you have any questions, please submit a comment. If you have better data collection suggestions for me or for anybody else who is interested in blogging (other than switching careers and becoming a realtor so I get the inside scoop!), please comment on that too!