South Bay Home Inventory Soars - realtor says the "leveling off could take years"

In a June 26 news release, Shorewood Realtors reports that the inventory of south bay homes for sale nearly tripled in May when compared YOY with May 2005. 215 homes were available in May 2005, while 623 homes were available in May 2006.

Not only are the beach cities of El Segundo, Manhattan Beach, Hermosa Beach, and Redondo Beach experiencing a huge jump in inventory. Hawthorne, Lawndale, Torrance, and Inglewood are also experiencing big jumps.

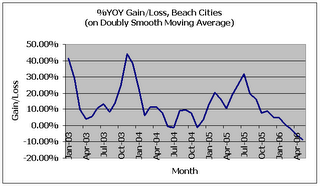

The number of sales in the beach cities is down 27.7% YOY from May 2005. May 2006 saw 164 homes sold, while May 2005 saw 227 homes sold. However, in spite of big inventory jumps, Hawthorne, Inglewood, and Torrance actually experienced increasing sales. Palos Verdes Estates also saw a higher number of sales, though it appears to experience big price swings, due in part to the relatively small number of transactions.

The number of days on market for the four beach cities was 37 days in May 2006 versus 26 days in May 2005.

A related article in the Daily Breeze (June 28: South Bay real estate sellers find fewer, pickier buyers) that quotes Mike Collins of Shorewood reports that the market is "transitioning from a seller's market to a buyer's market", but "we're not there yet". Higher interest rates and "the reluctance of many home buyers to sell their home to trade up" are cited as factors in the market slowdown. "A lot of people... purchased their homes in the last five years who have marvelous loans, great fixed rates for over 30 years... don't want to come out and play... they're happy."

An RE/MAX Beach Cities realtor who is also quoted in the article says, "I've been through a few of these cycles and I would expect this adjustment to last for a while, until prices get real again - however long that takes. I'm thinking years."

For all you bubble psychology watchers, isn't it interesting how these realtors still won't even mention unmentionable words like price decline in their press writeups, when they are fully aware it is inevitable? The politically correct term is now leveling off.