DQNews South Bay Resale Activity for September 2006

According to DQNews, the September monthly resale activity for the south bay area showed the following:

Zip # SFR Median %Chg # Condo Median %Chg

Sales $SFR YOY Sales $Condo YOY

90045 23 799,000 3.4 4 380,000 10.0

90245 3 680,000 -22.6 2 525,000 -2.8

90254 9 1,030,000 -12.0 6 1,070,000 -14.4

90260 18 548,000 11.1 5 438,000 30.7

90266 31 1,379,000 -13.8 6 1,701,000 48.6

90277 14 883,000 0.4 10 708,000 7.6

90278 26 769,000 -9.5 21 710,000 -1.4

County 5,588 541,000 3.0 1,436 406,000 0.2

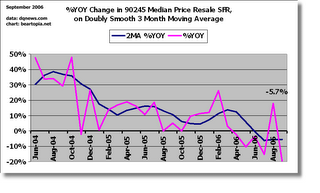

The beach cities charts below look strictly at resale activity for existing SFRs. The pink line is the raw %YOY change in the median price. The dark blue line is the %YOY on a doubly smooth 3 month moving average of the median price. I like to take moving averages because seasonal activity does not always "match up" (e.g., sometimes Easter sales fall more in March, sometimes more in April.) Beach cities zip codes are 90245 (El Segundo), 90254 (Hermosa Beach), 90266 (Manhattan Beach), 90277 (south Redondo Beach), and 90278 (north Redondo Beach).

The raw %YOY changes in my calculations (which I do not publish) do not always precisely match the DQNews published percentages, possibly because DataQuick might need to go back and revise already-published months. However, the differences are slight, and trends correspond very closely.

The percentages shown on the charts are for the Moving Average point for September. Moving Average is a lagging indicator, and it gives a much more conservative analysis of change than the raw numbers. MA gives generous leeway to the bubbleheads who are declaring that a bottom has been reached in the housing market. Based on this MA, median SFR prices for 90245, 90254, and 90278 are now in negative territory. But as you can see, 90277 is the only beach city zip code whose pink line (raw data) has not fallen below 0% into negative territory. A chart for L.A. County has been added, which shows a %YOY gain of 7% - again, very generous leeway to the bubbleheads.

0 Comments:

Post a Comment

<< Home