Thanks to GuyinLA for the heads-up on this one! This article by Martin Romjue in the September 2 Daily Breeze will disappear quickly, so I will show it here.

Whether the South Bay housing market has turned into a slumbering bear or a lumbering

bull depends on how you look at the market.

The Multiple Listing Service of properties for sale shows more homes with reduced

prices, and more cumulative days on the market.

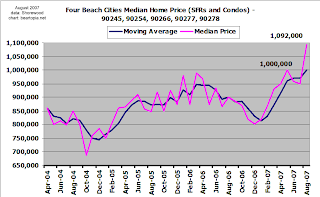

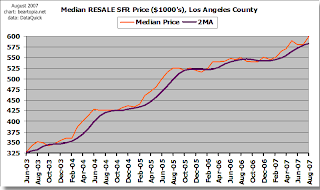

Monthly median home prices in the South Bay, however, are still ticking up overall.

According to the California Association of Realtors, the median price of a

single-family home in the South Bay in July was $690,000, up 7.9 percent from July

2006; in the beach cities it was $1,035,250, up 5.4 percent; on the Palos Verdes

Peninsula, it was $1,250,000, down 3.1 percent. Los Angeles County had a median price

of $550,000, up 5 percent.

So why are collective median prices in the South Bay and Los Angeles County mostly

going up if an increasing number of list prices of individual homes are going down?

"More than half of cities in Los Angeles County actually have year-to-year declines,"

said Robert Kleinhenz, deputy chief economist for California Association of Realtors.

"Higher-end markets are holding up better than lower end in terms of sales and

prices.

"The higher-ends make up a larger share of sales distribution by price range, so that

affects the calculation of median price," Kleinhenz said.

When looking at statewide sales data from Jan. 1 to July 31, 2007, versus the same

period in 2006, declines become more pronounced. Homes below $500,000 saw a 24.3

percent decline in sales; homes priced $500,000 to $750,000 saw a 26.4 percent

decline; and homes priced above $750,000, fell by just 5.4 percent.

The median price of homes below $750,000 actually fell 1.9 percent statewide since

Jan. 1. Median prices above $750,000 rose 2.2 percent.

Examples of reduced prices abound throughout the South Bay only two years after open

houses routinely attracted multiple same-day bids. Sellers increasingly use such

phrases as "Priced to sell!," "Seller very motivated!" and in one instance,

"Desperate!"

"I see (situations) where nobody is buying a house," said Warren Snyder, co-owner and

founder of Carriage Realty, American Broker Loans and American Credit Repair, all

based in Torrance. "You now have houses for four and five months on the market, and

you get one or two offers and they are 20 to 30 percent below price.

"Anyone out there buying a house is making offers that are absurdly low compared to

what we had before," he said. "The sellers just aren't used to that. It will take a

long time for sellers to adjust."

Snyder has sold real estate in the South Bay for 45 years, and believes he is

witnessing the fourth housing downturn in his career.

"This one will be the worst we've ever had," Snyder said. "It will involve so much

more of the economy than ever before. So many owners have turned homes into ATM

machines. If you'd done loans 10 years ago the way they're done today, you would have

been thrown in jail for fraud. So many people are in houses they can't afford. This

will be a tremendous problem over the next 18 months."

Snyder said homebuyers are more intelligent and better informed as a result of the

2000s real estate boom and current mortgage industry mess. Buyers no longer will

accept inflated prices on the most important purchase of their lives, he added.

"They're not going to buy a house that they think will be worth $200,000 less in a

year," Snyder said. "They are going to wait for things to level off."

However, at Coldwell Banker offices on the Palos Verdes Peninsula and in Manhattan

Beach, the market mantra might as well be: "Stairway to housing."

"Our circumstances here are different. The South Bay is a microcosm unto itself,"

said Shryl Lorino, manager of the Coldwell Banker office in Manhattan Beach. The

office opened in June 2006 and has grown to 17 agents working in the beach cities and

the wider South Bay.

The South Bay is "somewhat insulated," Lorino said. "There's so little coastal

property left. The concept of supply and demand will come into play here. I don't

have a crystal ball, but chances of there being a panic and real drastic change here

are slim."

While Lorino describes business as brisk, she calls this market more normal in that

buyers and sellers are taking their time and negotiating more often through offers

and counteroffers. Some sellers participate in loan buydown programs, in which a

seller, for example, pays for some points on a buyer's loan in order to make a deal.

"The market used to favor that impulsive, charismatic larger-than-life buyer that

attracts that type of seller," Lorino said. "Now everyone is more analytical. Now

there is time to mull things over to do your research and do your homework and not

have prices so drastically bumped up with multiple offers."

Leveling off is hardly what real estate investor and multiple homeowner Kyle Kazan

would use to describe circumstances throughout Southern California, including the

pricier enclaves of the South Bay.

"I believe the death spiral is on, and it will deflate values in real estate," said

Kazan, who owns Beach Front Real Estate Services in Long Beach. The company either

owns or manages 2,000 apartment units in Los Angeles and Orange counties, and invests

in properties in other states and foreign nations. His company's combined portfolio

is worth more than $250 million.

"The crazy appreciation in real estate in the last few years is now in reverse,"

Kazan said. "None of the South Bay is as much of an island as people believe. We're

all pretty well interconnected and tied together. The outlying areas get hit worst

and first, and then the flu spreads to more densely populated areas of Los Angeles

and Orange counties."

Kazan, who regularly analyzes real estate markets for a sophisticated group of

co-investors, said the 2002-03 housing market was the point where it lost its

discipline and became too frothy.

The perfect storm of rising foreclosures and defaults, increased short sales and

housing auctions, higher interest rates and tightened lending standards, and a

diminishing pool of eligible, yet pickier, homebuyers all are combining to force the

market downward, Kazan said.

"There will be wonderful opportunities for people if they still have good credit, and

a little cash," Kazan said. The housing market will take a few years to unwind, he

said, but predicts 2009 will be an optimum year to buy homes.

"The banks will let the auctions happen, and let values reset," Kazan said. "Lenders

are holding many homes on their balance sheets, and at some point will want to wipe

the red ink off their books."

Kleinhenz, the economist, said many deals are falling out of escrow because of

tighter lending standards and fewer mortgage options. "Buyers cannot consummate the

deal, which means homes stay longer on the market, which triggers further price

reductions," Kleinhenz said. "The credit crunch really hurt sales and prices as

through system."

But so far, downward scenarios are not on the radar screen for Kevin Moen, branch

manager for two Coldwell Banker offices in Palos Verdes Estates and in Rolling Hills

Estates, with a combined 130 agents covering the Peninsula and wider South Bay

region.

In the Palos Verdes Peninsula market, for example, year-to-year sales activity is up

26 percent, with inventory levels remaining constant, Moen said. He said the

vulnerable real estate markets are those with a lot of new homes, first-time buyers

and speculation.

"We're still seeing a lot of instances of multiple offers and high demand level,"

Moen said. "We're not seeing that desperation mode of a seller; we are obviously

going to see an occasional foreclosure, but we're not seeing a flood of inventory and

distress sales or people losing their jobs."

Moen said the real estate market of the 2005 peak year was "crazy" and "not healthy,"

and that the current return to normal is a good thing.

"If a property comes priced right, there are two or three potential buyers for that

property," Moen said. "If it's above the (comparable sales), then it will sit on the

market."

THE CHANGING MARKET

Some recent random data from the Multiple Listing Service used by South Bay real

estate agents:

A townhome in Rancho Palos Verdes with partial, panoramic ocean views shows a price

drop from $839,900 to $765,000 after more than 220 cumulative days on the market so

far. Price cut: $74,900.

A single-family home in north Redondo Beach on the market for more than 165 days

shows a price drop from $847,700 to $735,000. Price cut: $112,700.

A renovated townhome within one block of the oceanfront in south Redondo Beach shows

a price drop from $855,000 to $799,000 with more than 220 days on the market. Price

cut: $56,000.

A single-family home in the lower Hollywood Riviera section of Torrance has dropped

in price from $850,000 to $775,000 after more than 70 days on the market. Price cut:

$75,000.

And a single-family home in west Torrance has fallen from $749,900 to $678,900 after

more than 58 days on the market. Price cut: $71,000.

Some continue to insist that the South Bay is somehow immune to the mortgage and pricing problems that much of the rest of the country is experiencing.

In case you missed my 3 part article series about the last great housing slump in California, you can find it at these links. Pay close attention to the psychology and the mindset of market participants and observers during that time. During this previous experience they were saying exactly the same thing about how the South Bay was immune - which ended up being ridiculously false.

Part One

Part Two

Part Three