This December 6, 2006 article by Fred Sheehan called "A Brief, Superficial, and Arbitrary History of Property-Price Collapses" uses Los Angeles and Southern California as illustrations. The title of this post was quoted from David Starr Jordan, writing about a severe So Cal real estate bust in 1887 and 1888, despite a decade in which the population was doubling. Sheehan also looks at data from other historians and argues how the argument that demographics supports real estate prices is flawed. I admit it's difficult to verify the author's statement that nominal residential property prices in some part of the country have never recovered after the 1920's-1930's collapse. But do take note of what Sir John Templeton says at the end of the article.

The Anderson Forecast team at UCLA might restore one’s hope that academic economists

fulfill a productive function. Having disparaged the California housing boom through

its ascent, a springtime presentation by one of its economists predicted the swoon

that has come to pass. Alas, he stumbled. Asked if a real estate crash was in store,

he reverted to form: Southern California is in no way comparable to such one-industry

towns as Houston, and besides, California had never suffered a real estate meltdown.

On the first point, with 2% of adults in California now proudly waving real estate

licenses to sell, houses to California today may be as dominant a force as oil to

Houston in the 1980s. On the second point, one of the worst real estate debacles in

the history of the United States occurred on the ground where he stood.

More important than the misleading history lesson is the foregone opportunity to

profit. The banking system today is a far more reckless operation than during earlier

periods. This offers investment options.

Maybe the professor’s own education is lacking. For all the data spilling forth that

quantify current property trends (e.g., house sales, inventory, borrowing rates),

reference to past price changes is lacking. Unlike historical data on stock and bond

market peaks and valleys, the history of housing swoons lies entombed in the dark.

The information is difficult to collect, if it was ever collected at all. Therefore,

such formulations as “the stock market fell an average of x% during past market

breaks” do not exist. Yet, to ignore what we do know leaves us without any reference

when economists make off-the-cuff predictions with no fear of contradiction.

A recent example by America’s most successful mortgage broker was par for the guild

and for the man. On October 26, former Federal Reserve Chairman Alan Greenspan

mumbled that the housing slump is “likely past.” Exactly one week later, this

unsubstantiated opinion was expertly choreographed into a National Association of

Realtors $40-million-advertising campaign with full-page newspaper ads: “It’s a Great

Time to Buy or Sell a House.” According to the upper-right-hand quadrant of the

newsprint layout, the man who told the nation “a traditional fixed-rate mortgage

might be an expensive method of financing a loan” in February 2004, only to raise

rates two months later, assures us now that the fourth quarter (of 2006) will

“certainly be better than the third quarter.”

Alan Greenspan has always been wrong when it mattered. But that’s enough of him. What

follows is a brief, superficial, and arbitrary history of property-price collapses in

the United States. It is true any tenured economist would toss this summary into the

dustbin – only data worthy of correlation and regression analyses are worth knowing.

(Charles Kindleberger’s Manias, Panics and Crashes is chock full of property-crash

prices, but the late and great economist was his own man.) The intention of this

exposition is to annotate the broad generality that real estate prices never fall.

When Houston in the 1980s and Southern California in the 1990s are mentioned, these

tempests are qualified as local market quandaries. This is both selective (only

post-World-War II need apply) and faulty (the national price level dropped in 1964).

And besides, since most local markets across the country are falling now, parochial

dips in the past are worth visiting. Alas, the broad generality is what most everyone

knows and the National Association of Realtors should be congratulated for succeeding

so thoroughly in its marketing campaign.

In one sense, the post-War fixation is proper: the Federal Reserve’s money printing

press is greased and oiled to ward off a collapse in prices today. Yet, to save the

housing market by inflating credit is a remedy for a specific problem that would

cause a general epidemic. The Fed has no control over the direction of credit flows.

Should the current rate of credit growth spill into consumer prices, $50 hamburgers

will create a bull market in Ramen Pride. It is doubtful the unnerving private equity

flows today would exist if not for current Fed efforts to resurrect the moribund

housing market. If the authorities accelerate this vain effort, the credit inflation

will chase things and Spam will be served for Thanksgiving dinner.

Should the Fed either resist the temptation to hyperinflate, or find itself incapable

of doing so, the current housing market will fall into a much longer history of

bubbles. Here, the most important recurring characteristic is the propellant for all

such bubbles: credit. The recent mania was no different: it was not a housing feast

but an indulgence of mortgages.

A protracted exposition on California is explored for the benefit of haphazardly

tutored students at UCLA. Florida is next in line followed by some quick flybys of

other mortgage manias.

The population of Los Angeles rose from 10,000 in 1880 to 50,000 in 1890 and 100,000

in 1900. Yet, a severe real estate bust wiped out most of the wealth in 1887 and

1888. David Starr Jordan described the boom and bust in California and the

Californians: “[A]lmost every bluff along the coast, from Los Angeles to San Diego

and beyond was staked out in town lots.” He continued: “Every resident bought lots,

all the lots he could hold. The tourist took his hand in speculation. Corner lots in

San Diego, Del Mar, Azusa, Redlands, Riverside, Pasadena, anywhere brought fabulous

prices. A village was laid out in the uninhabited bed of a mountain torrent, and men

stood in the streets in Los Angeles… all night long, to wait their turn in buying

lots. Land, worthless and inaccessible, barren cliffs' river-wash, sand hills, cactus

deserts' sinks of alkali, everything met with ready sale. The belief that Southern

California would be one great city was universal. The desire to buy became a mania.

‘Millionaires of a day,’ even the shrewdest lost their heads, and the boom ended, as

such booms always end in utter collapse.”

Of course, those “Visionaries” who believed Southern California would be “one great

city” were correct. This was an impressive long-sighted prediction (and, we can be

sure, also promoters’ attempts to entice more fish to the lure), yet, “even the

shrewdest” lost their shirts. Those today who harp on “housing shortages” and the

demographic needs of a growing population should consider a city that went broke

during a decade of 500% incremental growth.

In 2006, “utter collapse” looks remote. It is difficult to imagine. It is drummed in

to us that the Fed would never permit another mass default such as occurred in the

1930s. So we turn to the 1890 account of T. S. Van Dyke, author of Millionaires for a

Day, who writes in terms a Californian might find enriching today, given the loan

markdowns – and tight credit – sure to beset the more aggressive local lenders: "The

money market tightened almost on the instant. From every quarter of the land the

drain of money outward had been enormous, and had been balanced only by the immense

amount constantly coming in. Almost from the day this inflow ceased money seemed

scarce everywhere, for the outgo still continued. Not only were vast sums going out

every day for water-pipe, railroad iron, cement, lumber, and other material for the

great improvements going on in every direction, most of which material had already

been ordered, but thousands more were still going out for diamonds and a host of

other things already bought – things that only increase the general indebtedness of

community by making those who cannot afford them imitate those who can. And tens of

thousands more were going out for butter, eggs, pork, and even potatoes and other

vegetables, which the luxurious boomers thought it beneath the dignity of

millionaires to raise."

Van Dyke’s paragraph addresses a handful of parallel booms and busts that accompany

any and all property credit booms and busts. These might be considered by the reader.

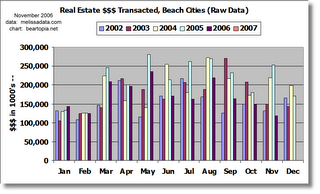

Of a more specific nature, we do know the population in Los Angeles proper was

supplemented by at least 200,000 transients in 1887. (Living in tents, they used the

post office for mail delivery.) We know that over 40% of houses bought nationwide in

2005 were for speculation or second (or third, or fourth) homes. (The Internet

rendered the pup tent unnecessary, making it possible to buy blocks of houses without

missing one’s favorite sitcom.) Price levels are hard to come by; the momentum of

day-traders is easier to track. We also know that the value of real estate

transactions in Los Angeles County exceeded $2 million for the first time in May

1886, passed $5 million in January 1887, $10 million in June 1887, $12 million in

July 1887, fell below $5 million in December 1887 and slid under $3 million in

November 1888. (The figures look small but it is the change in proportions that

matter. There was no Federal Reserve in those days to print and inflate the money

supply as it wished – the reader might feel more at home by replacing “million” with

“trillion.”)

Of greater immediate importance for those considering a short or put position against

California lenders, is the comparative recklessness of banks today. In The Boom of

the Eighties, Glenn S. Dumke found that banks became more conservative as the boom

reached its peak. “In 1885 loans amounted to 80% of deposits; in January 1887, to 62

½ per cent…. By July of 1887, less than half of the banks’ funds were on loan, and

six months thereafter only one quarter.” There were a couple of minor bank runs; the

banking system stood rock solid after the crash. All this, and without the 500 Ph.D.

economists on the Federal Reserve staff whose models have proved housing bubbles are

either inconsequential or cannot exist.

The Florida land mania of the 1920s offers another potentially fruitful comparison

for the contemporary investor – then, too, banks were tightwads compared to the

profit-mad lenders of today. Promoters descended on the state. Restaurants and delis

served lines of speculators coffee for 75 cents (with no cream) when the going price

for a cup in New York City was a nickel. In the summer of 1925, residents of Miami

placed “Not for Sale” signs to ward off the pests. Leases to realtors reached $700 a

square foot in Miami, when similar space at Broadway and 42nd Street in New York – a

very desirable location – rented for $13 a square foot. Even today, the top

commercial property rents in the world, in Hong Kong and London, top out at around

$250 and $220 a square foot, respectively.

The momentum traders in Miami, tracked by real estate transfers, increased volume

from 4,126 in January 1924 to 9,744 in January 1925 to 16,960 in October 1925 to

4,491 a year later. By March 10, 1926, it was reported that scores of small real

estate offices had been closed “overnight.” Miami real estate bond houses took

advantage of a stock market break in that same month. They waged a full-page ad

campaign: “How Wall Street Lost $4 Billion: and how you can forever escape such

losses.” It seems safe to say the credulous readers of National Association of

Realtors propaganda today will be just as dissatisfied as the followers of Miami bond

touts 80 years ago.

Price depreciations are anecdotal, though a good part of the property went to zero.

D.P. Davis sold 875 acres near Tampa in 1924 for $18 million. People waited in line

40 hours before the sale began. Most of the property was underwater. In 2005, San

Diego-based Zarzar Land sold 10- and 20-acre lots of West Texas desert to eager

buyers on eBay. The land was worthless. The local school district included 53

students. It took 100 acres to support each cow. The Texas Attorney General’s office

was asked to interfere but decided not to. “The only thing we could take action on is

something like the Deceptive Practices Act, but if you look at their websites, they

tell people there is no survey, no water, no utilities,” reckoned the Assistant

Attorney General.

A skeptical view of the media would go a long way to restoring common sense. The

parade of economists who echo Greenspan are daily features in the newspapers and

television. In mid-summer 1925, the Miami Daily News set a New World Record with a

506-page edition – almost all of it real estate advertising. On October 25, 1925, the

Miami Herald published a story planted by a movie and real estate promoter who

cautioned, “a treacherous Arctic current had been discovered off the coast of

California and in a few years would freeze the California climate so severely that

filmmakers would have to quit Hollywood and ship their studios to Florida.”

Homer B. Vanderblue wrote in 1927 the money spent on skyscrapers in Miami “has

probably been lost exactly as though it had been sunk in drilling dry holes in an oil

field.” In May 2005, Miami boasted 60,000 condominiums that had been sold but not yet

built. Prices of houses and condos rose 28% in 2005. In South Beach, Miami, a new,

20-story condominium sold beach cabanas for $850,000 apiece.

That was last year. In 2006, the city’s condo supply is leapfrogging demand.

According to Multiple Listing Service of Miami, 34% of the houses and condominiums on

the market have dropped their price. Many listings, of course, have de-listed. But

building continues at a ferocious rate: Empire World Towers, two, 106-story hotel and

apartment buildings, are awaiting approval by the Federal Aviation Authority. Cranes

over Miami are giving Shanghai and Dubai a run for the most blighted skyline.

Money poured in from points north and west. After the break, it fled. Deposits of

clearing house banks in Miami rose from $56 million on December 31, 1924, to $191

million in August 1925, and then fell to $98 million in June 1926. There were

failures, but, as in California, the banking system acquitted itself. Vanderblue

reported: “[T]he condition faced by the Florida bankers in 1924 and 1925 was quite

unprecedented, and it is more remarkable, and greatly to their credit, that most of

them were prepared for the shrinkage in deposits when it came. The plethora of funds

had not been allowed to flow into land speculation but was invested mainly in

corporate and government bonds…. The bank failures were relatively few in numbers….”

Vanderblue goes on to commend the governor of the Federal Reserve Bank of Atlanta who

visited every Fed member bank and made sure they were prepared for a collapse. Only

one Fed member bank in the district failed. By comparison, Greenspan’s bizarre,

February 2004, adjustable-rate “exotic loan” speech was pitched to the Credit Union

National Association in Washington. The Fed chairman’s Open Wallet Policy was a clear

signature of approval for the most irresponsible Florida banks and developers – some

of whom must now wish the Atlanta Fed governor of 1925 was their regulator in 2005.

It is difficult to offer a comparison to the fate of Florida bank shares today. For

what it’s worth, the common stock of the Land Company of Florida rose from $50 on

September 11, 1925, to $89-3/4 at the end of the same month. A year later the

theoretical price was $20 but was rarely traded.

Florida is merely the most benighted of the 1920s property speculation – the building

spree crossed the nation. Losses were much greater than from the stock market crash.

Prices in many cities have never recovered. Nominal prices of Baltimore residential

property prices are still lower than in the 1920s. Prime commercial property prices

in Omaha still trade at a discount to Jazz Age highs. In Boston, a lot on Boylston

Street near Copley Square sold for $2.12 a square foot in 1873, $35.30 in 1912 and

$3.00 in 1939. A building on Boston’s Arch Street sold for $33 a square foot in 1881

and traded for $5.13 sq. ft. in 1940. A lot between Summer and Essex Streets sold for

$2.50 in 1831, for $32.16 in 1916 and $1.80 sq. ft. in 1940.

The dollar has lost approximately 90% of its value since the 1920s. Besides being

wrong on even a nominal basis, the claim that real estate prices always go up does

not address what those dollars –going up, down, or sideways – would buy. Homer Hoyt’s

One Hundred Years of Land Values in Chicago shows that some of the most fashionable

addresses between the 1860s and 1880s – Michigan Avenue, Dearborn Street, Prairie

Avenue – sold at prices as much as 50% lower at the height of the 1920s boom, and

were often 90% lower than their peaks by the 1930s. Economists, especially from real

estate trade organizations, love to drag out the argument that demographics support

real estate prices. Yet the population of Chicago rose from 109,000 in 1860 to

3,376,000 in 1930. (A great visionary who correctly forecast Chicago’s future from

his Prairie Avenue mansion in the 1870s may still have gone broke if he was dealing

in real estate.)

John Templeton, who has absorbed price changes in many markets across several

decades, told Equities magazine in 2003 (well before the peak): “Almost everyone has

a home mortgage and some are 89% of the value of the home (and yes, some are even

more.) If home prices start down, there will be bankruptcies, and in bankruptcy,

houses are sold at lower prices, pushing down home prices further. After home prices

go down to one-tenth of the higher price homeowners paid, buy them.”