Housing costs have become too rich for many, making this the most popular state to leave, according to this September 17, 2006 story by Muhammed El-Hasan in the Daily Breeze (link will expire).

You'd think that with the influx of immigrants (legal and otherwise), California population would be growing. But not according to this article. The net outflow between July 1, 2000 and July 1, 2005 exceeded an average of 133,000 people a year. The current rate is about twice that, and this is at a time of a "strong" economy. The outflow is at its highest point since the mid-1990's, when an aerospace downturn and recession drove so many out of state. Los Angeles County saw a net outflow of 154,320 residents to other counties from July 1, 2004, to July 1, 2005, according to the Census Bureau. (The article does not say it but I suspect San Bernadino and Riverside counties are popular destinations.) The outflow of residents from California has been good news for realtors in places like Las Vegas.

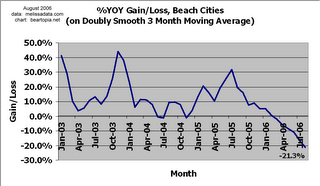

Gee, do you think our surrealestate values have anything to do with it?

The July median price for a SFR in all of California was $567,360 according to the California Association of Realtors. In Torrance, that figure was $610,000. Prices were about half their current level just five short years ago.

Right now, despite the net outflow, California remains a popular immigrant destination. I'm not sure if the article is contradicting itself or not, but it goes on to say that "the number of immigrants admitted to the state from Oct. 1, 2004, to Sept. 30, 2005, almost equaled the net loss of residents to other states from July 1, 2004, to July 1, 2005. California's immigrant infusion appears to effectively nullify the population loss to other states, in terms of numbers."

It is my own opinion that if an economic slide downward were to materialize, this could greatly change, as nations move toward restricting immigration (people tend to get more xenophobic during economic hard times). Restricting immigration to California would probably exacerbate an economic/real estate downtrend - who's going to buy up all those dot condos and houses? Of course by the time we were to reach this point, it is possible that credit would be greatly tightened, making it much more difficult for anybody - immigrant or resident - to buy property on what might seem like very conservative terms right now. It's difficult to anticipate exactly what will happen.

If you haven't read it, I strongly recommend Schizomania, which macroeconomically explores real estate as a part of our development over 120 year cycles that overlap each other. Long-term migration patterns play the most significant role in the future real estate boom areas and bust areas.

----------------------------------------------------------------------------

Go west, young man.

Or maybe not.

The popular 19th-century adage urging Americans to move westward in search of new

opportunities has been turned on its ear -- at least where California is concerned.

The nation's most populous state, a traditional magnet for throngs of daring,

ambitious people seeking everything from gold nuggets and great weather to good jobs

and Hollywood glamour, now carries an unflattering designation.

The Golden State is No. 1 in outward migration of residents to other states,

according to the most recent figures provided by the U.S. Census Bureau.

From July 1, 2004, to July 1, 2005, the net flow of residents from California to

other states -- those moving to the state minus those leaving -- was negative 239,000

people. That's higher than any other state in the union.

California even edged out former No. 1 New York by 7,000 people.

"You think of California as kind of a growing state. And overall, California did gain

population," said Robert Bernstein, a Census Bureau spokesman. "But (it was) because

a natural increase and immigration from abroad exceeded the loss to other states."

California has been losing residents to other states each year since the period of

July 1, 1988, to July 1, 1989, when the outflow began as a trickle.

As of last year, the state's outflow was at its highest point since the mid-1990s,

when a severe recession and aerospace industry slump drove engineers and other

professionals out of California in search of work.

Back then, the departures peaked from July 1, 1993, to July 1, 1994, with a net

outflow that surpassed 400,000 residents.

But instead of returning to California's historical trend of a positive net inflow of

residents, the outflow has continued nonstop.

And after a lull of a few years, the net departures again seem to be accelerating.

For example, the period from July 1, 2000, to July 1, 2005, saw a net outflow of

664,000 people from California, an average of nearly 133,000 a year.

That average is about half of the latest figure.

As a percentage of population, New York still has greater outward migration of

residents to other states than does California.

"But that still begs the question: Why are nearly 240,000 people leaving

(California)?" said Paul Ong, a demographics expert at the UCLA School of Public

Affairs.

The current outflow comes at a time of relative economic strength and moderate job

growth in the state.

In contrast to the recession of the 1990s, this most recent outflow has been driven

mostly by an economic boom.

The housing boom has made buying a home or even renting much more expensive than just

a few years ago. That has inspired many of the state's residents to eye cheaper homes

in other states while giving pause to those considering a move to California.

"California is an extremely expensive place to live, particularly compared to some of

the markets close by like Phoenix or Las Vegas, (where) you can get a lot more house

for your money," said Steve Cochrane, senior managing director of Moody's Economy.com

in Westchester, Pa.

In July, the median price for an existing, single-family detached home in California

was $567,360, according to the Los Angeles-based California Association of Realtors.

The figure for Torrance was $610,000.

For California, Torrance and many other cities statewide, you would have to go back

only five years to find prices at half their current value.

This has made otherwise robust home appreciation in other parts of the nation look

downright meager.

"Look at San Francisco and parts of Los Angeles," Ong said. "If you look at the last

decade or so, the people who can afford to stay tend to be better educated and higher

income. It's driving out working-class people with children. They're moving to the

suburbs. Some of that must spill into moving to other states."

As a result, Los Angeles County saw a net outflow of 154,320 residents to other

counties from July 1, 2004, to July 1, 2005, according to the Census Bureau.

Ong added that even with the current slowdown in home appreciation, the damage

already has been done since the prices have reached a "very high plateau."

California's high cost of living may help explain why about four in 10 Nissan

employees followed their jobs out of state when the company's North American sales

and marketing headquarters moved from Carson to Nashville over June and July.

So, where are Californians moving to?

From 1995 to 2000, the most recent period with available statistics from the Census

Bureau, the top destination state was Nevada. Arizona came in second, followed by

Texas, Washington state, Oregon, Colorado and Florida.

Each of these states had a positive net migration of residents into their borders,

according to the latest census figures. Most are relatively close to California. And

all are less expensive.

That's good news for Jason Braford, ZipRealty's Las Vegas district director.

"We're seeing a continual influx of people from California," Braford said. "The

lion's share are people coming in from California."

Home prices, lower taxes, shorter commutes and a burgeoning community in Las Vegas

entice many Californians, Braford said.

"In California, you can (sell) your $500,000 or $600,000 property, you can come here

and usually you get something that's in the $300,000 to $400,000 range and gain in

lot size," Braford said.

In addition, people moving from the East Coast and Midwest in search of a warmer

climate usually first look either to Los Angeles or Las Vegas, Braford said. But

often Las Vegas wins out because of California's higher cost of living, he said.

A survey conducted by UCLA demographers found that most Southern Californians still

see this region as attractive. The top three positive elements cited were the

weather, economic opportunity and cultural diversity, said Ong, who worked on the

survey.

"Transportation and traffic emerged as the least attractive aspect of Southern

California," Ong said.

Pollution, crime and public schools also were viewed as problems.

"We've reached the point where our amenities are being outweighed by some of the

perceived costs -- air pollution, crowding, congestion and so forth," Ong said.

In addition to so-called "push" forces such as high home prices that make California

seem less hospitable, a big "pull" comes from other states, Economy.com's Cochrane

said.

"The rate of growth of employment in California is OK, but it's not great. It's

average at best," Cochrane said. "There are a lot more fast-growing areas (like)

Arizona, Nevada, Colorado, Utah, Washington state. And increasingly, Texas is back on

its feet.

"So, for economic reasons, there's a pull from the surrounding region because of

employment opportunities, and there's a bit of a push from California because of the

expense of staying in California."

Despite California's net loss of residents to other states, in a seeming

contradiction, the Golden State remained No. 1 in attracting foreign immigrants,

drawing about one in every five entering the U.S., according to Office of Immigration

Statistics figures for Oct. 1, 2004 to Sept. 30, 2005, the latest available.

Indeed, California's 232,000 foreign newcomers in that period were nearly double that

of the second top immigrant magnet, New York.

California's ethnic diversity is a big reason for the attraction despite the high

cost of living, Cochrane said.

"Migrants go where there's a place to live and where there's a support system,"

Cochrane said. "And certainly all of California, and L.A. in particular, provide that

for migrants in many regions of the world."

Another reason for California's popularity with immigrants is the state's massive

economy that offers vast job opportunities, Cochrane said.

He added that coastal cities such as Los Angeles traditionally have served as points

of entry for foreigners.

California's immigrant inflow plays an especially critical role, given the state's

outflow of residents to other states, Cochrane said.

Notably, the number of immigrants admitted to the state from Oct. 1, 2004, to Sept.

30, 2005, almost equaled the net loss of residents to other states from July 1, 2004,

to July 1, 2005.

California's immigrant infusion appears to effectively nullify the population loss to

other states, in terms of numbers.

That reality bears heavily on the state's economy, Cochrane said. The pace of

economic growth is based partly on the work force's rate of increase. A slow rise in

the work force's size could stunt economic expansion by limiting the labor supply.

"California depends so much on international migration, particularly to maintain

positive (economic) growth," he said.