I managed to pick up a few more sales for December in my records and reconcile them with my SUPPLY (inventory) records. Here is my second shot at a preliminary estimate for Redondo Beach for December.

STAT JUN 2007 JUL 2007 AUG 2007 SEP 2007 OCT 2007 NOV 2007 DEC 2007

records 62 78 51 68 44 37 29

MEDIAN $764,500 $860,000 $850,000 $857,000 $755,000 $832,500 $775,000

AVERAGE $830,711 $880,279 $867,925 $935,506 $770,416 $933,956 $822,393

MIN $485,000 $359,000 $365,000 $369,900 $369,900 $379,000 $486,500

MAX $1,565,000 $2,299,000 $1,510,000 $2,400,000 $2,560,000 $2,500,000 $1,500,000

Here are the revised charts. I find it interesting that the PCTRED (the difference between final selling price and original asking price) shows an even greater change. The only other thing I find interesting is that those folks who are able to write checks for properties exceeding $1 million seem to have been on vacation this month. Prices seem to have sunk back down.

I tried my best to update all current asking prices in the supply records in my database and then I took another inventory snapshot. For these properties, median original asking price is $849,000, average is $997,947. Median current asking price is $825,000, and average is $959.946. So we see some divergence between unsold properties and sold properties again, which may be due to the wealthier home buyers not buying anything in December.

Here are the charts.

Square footage tends to run slightly higher on the unsold properties than on sold properties.

DOM continues to be quite bottom-heavy. In spite of my efforts to clean up some of this unresolved inventory a few months ago, the bottom heaviness persists. Median is running at 200 days, and average is 228. Average is running in excess of 7 months!

For normal markets in other slower parts of the country, it probably isn't unusual for properties to sit on the markets for longer than 6 months. For Southern Californians spoiled by years of appreciation in excess of 20% annually and lines of people to bid on hot properties, 6 months could be an eternity in hell.

This is a far cry from the DOM of 49 that was reported last month for the beach cities by Shorewood, isn't it. DOM obviously means different things to different people. I define it as "time spent hustling a property", which is something like the continuous DOM that some realtors use, but not exactly.

I would not expect the percent reductions from original asking prices to exceed that for properties that were successfully sold, and that indeed is the case. On roughly 50% of these unresolved properties, sellers have either not lowered their prices or actually increased their asking prices. The median change in asking price is 0.1%, and the average is 3.3%. The median has finally moved off of 0%, but barely. So are these sellers on a fishing expedition, or are they serious about getting their homes sold?

Speaking of serious sellers, check out this January 13 L.A. Times article by Darryl Satzman: "Current market leaves sellers nostalgic for 2006." Although I still personally believe economist Chris Thornberg is too optimistic when he says prices will stay flat between 2009 and 2011, he is one of the few economists who has been somewhat ahead of this collapse. I find it interesting that whereas in 2006 most economists said that the solid job market in California would lessen the likelihood of any real weakness in the housing market and demand would remain strong, now the folks at DataQuick are saying that job growth numbers are "volatile."

I also think it is irrelevant whether there is a recession or not as to whether the downturn will get worse. Some economists define a recession as 2 consecutive down quarters, which in my opinion is like defining a tree as having 35 branches with a circumference at the base greater than 3 inches. A diseased economy can take many forms that do not precisely fit an economist's irrelevant definition, so who cares if it's labeled a recession or not?!? Some of these economists still apparently have not yet caught on to the fact that the economy has been so dependent on the housing market and the tail has been wagging the dog.

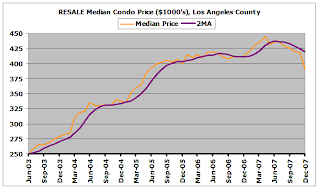

DataQuick thinks Los Angeles County will hold up better than Riverside due to older housing stock and people being in their homes longer. There may be some merit to that argument, but I want to add two caveats here. One is that the rug has been pulled out from under the mortgage market, so even a $400,000 property might as well be $1 trillion in the eyes of some potential buyers. In spite of all the pissing and moaning in the press about the slow housing market, the fact remains that the credit bubble is still built into several years of housing prices here in Los Angeles, and that needs to be deflated. We have experienced a mild price decline, but on sales that are running somewhere between 25% and 33% of what they were just a few short years ago. There's lots of credit bubble to realize still in prices. Second, what direction will social mood take? In a population experiencing a negative mood toward the housing market, what will a riot or a timely earthquake or other calamity do to worsen people's perceptions of the housing market? During a positive mood phase, such calamities are viewed as obstacles that we can bravely overcome, but in a negative mood phase, those events become excuses to bail out and leave.