Update on Current Market Conditions, March 2006

Goodness, I have not even had time to catch my breath since coming back from Colorado. By the way, the pace out there of everything is much slower than here, which is kind of nice, actually. Beautiful state, Colorado. Unlike the northeast or east, where the snow can sock you in for days and just weigh down everything so heavily, the snow can fall one day in Colorado and be gone the next, thanks to the dry air.

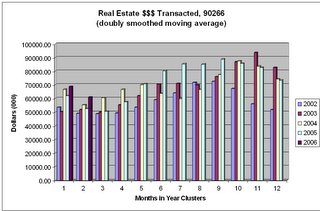

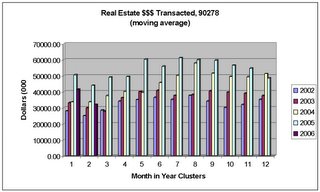

Fortunately I have a three day weekend coming so MAYBE I will get a little time to catch up here. Next week I will update my doubly smoothed moving average graphs with March sales data.

The last time we checked, 90278 (north Redondo) and 90254 (Hermosa) were showing signs of a housing slowdown. Let's see what the most recent data tells us, and let's see if the realtors are corroborating this, or denying this, or reluctantly acknowledging this, or whatever.

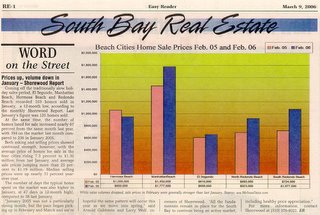

According to DQ News, the February Monthly resale activity showed the following:

Zip # SFR Median %Chg # Condo Median %Chg

Sales $SFR YOY Sales $Condo YOY

90045 21 769,000 8.6 4 407,000 n/a

90245 4 920,000 26.5 6 465,000 10.3

90254 4 970,000 -2.1 4 1,120,000 39.1

90260 8 580,000 27.8 5 370,000 17.5

90266 22 1,950,000 23.8 3 850,000 -35.7

90277 10 1,000,000 23.5 9 600,000 -6.1

90278 17 731,000 2.0 16 655,000 6.4

One month does not a trend make, and small numbers skew trends further. But are we starting to see cracks in the condo market? Also, my zip of 90278 has been showing the clearest, most persistent weakness.

On 3/16, Maddy Cespedes ranked both the Current Market and Current Price Trend 3 out of 5. She reports, without commenting on comparisons year over year:

Homes that are well-situated, priced correctly and marketed properly are selling quickly (an average of 30 days). There has been 48 residential sales in the month of February 2006, 31 in North Redondo and 17 in South Redondo. Condominium prices started at $ 470,000. The highest price paid for a single family residence was $1,280,000 in South Redondo. Properties had been in the market for an average of 74 days.On 3/20, realtor Robert Kissig ranks both the Current Market and the Current Price trend 5 out of 5, which really does not match his report:

Buyers are much more selective and looking for only the best properties. Its becoming a buyer's market... A sharp drop in home prices is not expected...The forecast remains strong.

If it is a buyer's market, I would have expected him to have ranked Current Market at 1, 2, or 3.

Don Tambini ranks both the Current Market and Current Price Trend 3 out of 5. He gives the following SFR sales data for February for all Redondo Beach:

# SFRs sold avg $$$ DOM Real Estate $$$ Transacted

2006 16 866,000 76 13,856,000

2005 23 837,000 42 19,251,000

Mr. Tambini did not provide that last column - I did. But you can see he has given us the proper data to get real estate $$$ transacted for SFR when compared YOY. With number of transactions down, DOM rising, and fewer $$$ transacted, realtors must be starting to feel like they are scrambling for a smaller share of this pie.

Stay tuned...