I have had a few stark reminders recently of why I don't want to own property where I currently live, in north Redondo, and why my significant other and I plan to eventually move out of Southern California.

On a very recent Saturday night we attended a potluck in downtown Manhattan Beach. It was the night that a volleyball tournament had taken place. We were running a little late, and on Manhattan Beach Blvd our car followed four police cars with lights flashing into downtown. There was obviously a lot of rowdy activity going on. From the spa where we were attending the potluck, we caught a glimpse of one drunken bozo staggering around with nothing but his underwear briefs on. Most of the other loud drunken revelers still had their clothes on. I looked at my significant other and said to him, "People pay several million dollars to live here and they put up with this kind of idiotic behavior?!?" Maybe I'm just too old or I am not the type to appreciate this magnificent beach lifestyle.

As I sit here in the study of my apartment with the window open to try to cool down this room, I can hear somebody two doors away yelling and swearing. The close proximity to our neighbors has been annoyance on many occasions and has literally kept me awake at night.

Anyway, back to the data.

My working set of data is pulled mostly out of Manhattan Beach Reporter, with a few out of Zillow. I have 49 records for July, which comes up short, so let's hope I have a good representative set of data.

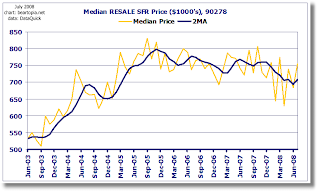

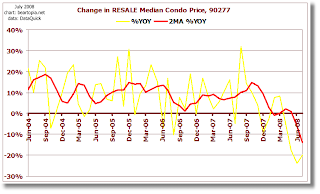

Sales are continuing to mark to market all these price cuts I've been recording for so many months, which is good. It's when sales dry up that we don't know what is going on in the heads of buyers and sellers in terms of their perception of valuations. When I calculated median and average Redondo Beach sale price for July 2007 I had 78 records and I came up with median and average price of $860,000 and $880,279, respectively. For July 2008 I have $752,000 and $786,136. My July 2008 median sale price is down -12.5% YOY. I think there is a good chance we will continue to see YOY prices slide when the official numbers come out later this month from DataQuick - however, if this market is currently driven by higher end sales, we may see an increase from June.

Sale Price

STAT JAN 2008 FEB 2008 MAR 2008 APR 2008 MAY 2008 JUN 2008 JUL 2008

records 25 25 35 40 61 50 49

MEDIAN $795,000 $755,000 $789,000 $756,000 $742,000 $704,000 $752,000

AVERAGE $932,117 $831,500 $961,714 $833,000 $775,589 $754,000 $786,136

MIN $449,900 $520,000 $585,000 $420,000 $269,900 $420,000 $449,500

MAX $2,130,000 $1,590,000 $2,100,000 $2,425,000 $1,430,000 $1,351,000 $1,725,000

Sales by Square Footage

For July 2007 I calculated the median square footage of a sold property at 1762 and the average at 1838. For July 2008 my calculations came in at 1892 and 1956, respectively. Both numbers are up substantially, lending credence to the idea that higher-end sales have been driving the market very recently.

DOM (Time on Market)

My July 2007 calculation of time on market was a median 68 days and an average 104 days. For July 2008 I come up with 138 and 204, respectively. This has edged up from my prior month calculations. The "tale of two markets" continues, with literally two axes in the graph - one for the home sellers who sold relatively quickly, and one axis for those whose properties have been sitting on the market for literally years now. I doubt the median and the average are reflective of the typical current homeseller's experience. Either the property has been sitting on the market for ages and has had its price reduced substantially, or the nervous homeseller has entered the market with a very competitive price and succeeded in getting the property sold relatively quickly.

Percent Reductions

And how much did sellers have to lower their asking prices in order to make their sales? For July 2007, I calculated a median reduction of 1.91% and an average reduction of 3.87%. For July 2008, I have calculated a median reduction of 7.41% and an average reduction of 8.75% for sold properties. There is virtually no change from June.

Asking Price History

Median asking price for properties entering the market in July (or for which I have reductions still recorded for July) seems to have taken a sharp turn up, to $799,000. Hope springs eternal. After all, this is supposed to be THE best time of year for this housing market. My feeling is these sellers will experience the same disappointment at not getting their dream asking prices as a lot of other sellers are experiencing. Be sure to read Mr. Mortgage's blog and watch his videos for an explanation of what's coming down the California pipeline.

July Short Sales

Out of 49 sale records I have recorded, I show 11 short sales, but one prior sale record is highly questionable, so let's call it 10. Ten short sales is exceeding 20% of the sales I have recorded.

If I throw out the questionable record for Anita Street, the average short sale difference I recorded is 9%.

I have not yet discovered a short sale from a prior sale in 2003.

SALE PRIOR SALE % ADDRESS

DATE DATE RED

2008-07-28 2005-06-17 -5.0% 2317 Harriman Lane B

2008-07-23 2005-11-15 -6.0% 531 Esplanade 304

2008-07-21 2004-04-29 -2.0% 2110 Rockefeller Lane 2

2008-07-07 2007-02-21 -1.0% 1636 Goodman Avenue

2008-07-18 2005-05-13 -21.0% 2408 Phelan Lane A

2008-07-07 2008-01-28 -23.0% 419 Anita Street A

2008-07-28 2005-11-15 -10.0% 2109 Plant Avenue B

2008-07-28 2004-04-15 -1.0% 2503 Rindge Lane

2008-07-18 2005-09-27 -9.0% 1516 Ford Avenue

2008-07-14 2007-03-28 -6.0% 200 S. Catalina Avenue 101

2008-07-21 2005-08-16 -29.0% 510 The Village 307