Real Estate $$$ Transacted through July 2006 for Beach Cities

The spring of real estate $$$ that started seeping out of the beach cities as early as a year ago has graduated to a loudly babbling brook.

In terms of transaction $$$, July is the worst July for the beach cities in several years. Note in the raw data below how July 2006 compares to Julys back through 2002.

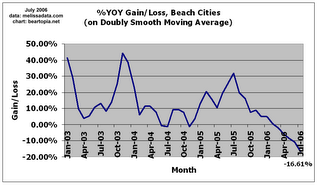

By a smoother measure, the trend is steadily stepping down.

Look at that YOY trend on the doubly smooth moving average. It peaked one year ago and started to decelerate. It actually went negative, meaning that real estate transaction $$$ started declining, around February and March of 2006. A few times in 2004, it looks like the trend came down to 0% but then bounced back up again. So far, we have not seen that bounce back.

Let's look at the westside. 90034 (Palms), is showing -35%, Rancho Park (90064) -30%, Mar Vista (90066) -6%, 90230 (Culver City), is still hovering around 0%, while 90232 (Culver City) is -16%. Venice (90291) is -20%, and Playa Del Rey is down -48%. On the other hand, Westchester (90045) is still gaining by over 13%, Playa Vista is still on steroids at 144%, and Marina Del Rey is gaining at over 7%, though it's trend has been declining steadily since January.

And now for the beach city zip codes. 90245 (El Segundo) is doing by far the best, having rebounded into April but now leveling off again. Its gaining at just over 2%. 90254 (Hermosa Beach) is -19%, 90266, the mighty Manhattan Beach is nearly -5%, 90277 (south Redondo Beach) is -40%, and 90278 (north Redondo Beach), is nearly -18%. Realtors must be feeling this!

How about the surrounding areas? 90250 (Hawthorne) looks still looks like it has a bit of strength, at over 4%. This is the zip code of Fusion at South Bay, so the sales will show up here. 90260 (Lawndale) has been on an uptrend since October 2005 and is now at over 12%. It's one of the most resistant areas. Inglewood overall is doing well. 90301 is up over 13%, 90302 is over 30%, 90303 is nearly 23%, 90304 is nearly 14%, and 90305 is on steroids at over 284%. 90501 (Torrance) is barely hovering above 0% at 2%, 90502 is at 34% though clearly trending down, 90503 is down nearly -14%, 90504 seems to be shooting up again, at over 16%, 90505 is also in an upshoot, at over 9%. 90717 (Lomita), on the other hand, is down nearly -16%. Keep in mind there are some huge new condo projects being built in Torrance.

Has the south bay beach bubble officially burst? Perhaps so, but I'd feel better seeing a confirmation from median price activity. So far, YOY gains in median prices for single family residences (SFRs) in the beach cities remain above 0%, though they appear to be generally working their way downwards. From all the other evidence, we'll get there. I'd also feel better when I see even the stronger surrounding areas starting to show negative YOY trends. My overall impression is that there are still desperate buyers out there who are priced out of the more expensive areas and who are unaware of the increasing weakness in L.A. County overall.

If I were forced to make a prediction about who is going to be blamed for the real estate bubble bust, I would say (other than the bloggers), that builders are going to be fingered at some point. They are dumping massive amounts of new construction on the market, and they'll be blamed for making it more difficult for existing homeowners to sell their homes. Cest la vie.

If you are new to this blog, you can find a more detailed explanation of these charts as well as breakdown by zip code at the Beartopia South Bay bubble tracker. Have fun!

8 Comments:

Can anyone access the names of recent purchasers in the borderline beach cities, (ex. Inglewood) that are still showing rapid sales? I am betting that vast majority of recent purchasers are Hispanic.

During the final stage of this bubble, many Mortgage Companies are actively targeting the Spanish speaking population promoting home "ownership" via "suicide loans." (Just last week I spoke with a friend who is a loan officer with a company that just switched their business model to target the Hispanic market.)

Due to language barriers, the Hispanic homebuyers will be slower to catch on to the slowing market - and even easier prey for the Mortgage vultures. Many will not understand the terms of their 1-year teaser rate-negative-amortization-ARM-loan.

Mortgage Companies are also targeting the African American population in the South Bay. In June there was a big push for a RE seminar in Inglewood "100 Homes in 100 Days," to increase African American homeownership. I was sad to see that the sponsoring Mortgage Company had enlisted African American politicians and community leaders to market this campaign.

In the last stages of the ponzi scheme these populations are purposefully being targeted. As the savvier grab for chairs in the game of musical chairs, these uninformed borrowers are closing on their suicide loans at stratospheric prices just as the music stops...

melissadata.com has a new homeowner list that can be ordered from them (for $$$).

If you are familiar with Socionomics, as hypothesized by Bob Prechter, minority and 2nd class citizen participation (in this country maybe not even citizens) is one of the characteristics of very late in a boom. I'm pretty sure Wall Street started marketing the stock market to women and ethnic groups late in the stock market boom.

Manhattan Beach has been powerfully fueled by sports star dollars as well as other fantasyland rich people dollars, and that will still probably continue for some time, before bear market mass pschology knocks some sense into us and wakes us up to realize that sports stars really aren't worth the astronomical salaries. But in the meantime, these sports stars have the $$$ to back up their purchases so I am assuming they don't have the debt burden that a lot of homeowners in the area might have.

For July, sales numbers have definitely fallen in both Manhattan Beach and Hermosa have fallen in addition to sales numbers in north and south Redondo. I don't sense that people are giving up on Redondo for opportunities in Hermosa and Manhattan. I sense that new homebuyers are looking completely outside this beach city area.

Personally it's a matter of taste, but if I had to buy, I think I'd prefer south Redondo over Hermosa. There are lots of attractive older homes in south Redondo that I love, whereas Hermosa reminds me of an enormous frat house.

Remember I take this one month at a time. If I had to guesstimate the nearterm trend I think August and September could see a little rebound. I suspect July is a strong vacation month, when people are less interested in buying homes, and August and September are the "buy a house now before the school season starts" months.

I have just sent emails to Zillow and Domania telling them that whomever provided them recent sales data on 3191 Setag (scrambled address) made an error. That house was listed for about $1 mil early this year, and I actually visited it. It delisted, then was relisted again in May or June. Now the reporting agencies say that it sold for $2.4 million in July. No way, unless somebody discovered a gold mine underneath the house!

Bearmaster,

Thank you again for the great stats! So we're finally seeing negative... But not enough for it to be "common knowledge." Very interesting.

I'm just curious why has So Redondo fallen off the cliff first (-40%) (by larenter).

Most likely due to south Redondo giving up its recently aquired trendy status. As there are two locations within "south redondo" that are on my radar... I'm not exactly sad to see this. ;) Yet, I have friends who will be creamed by the drop. :( Cest la vie.

I'm calling my fiance' now to tell her about south Redondo. Note: We won't buy for at least 18 months, probably a little later. As I noted before, I'll buy early when the inventory is *huge* as I really want "location location location."

Neil

Yay to this site! :-)

I was given a link to this site from 'housing doom' (thank you larenter) , as most of the other blogs are centred around San Diego.

I'm looking at places slightly further north (Santa Monica, Pacific Palisades, Topanga, inland Malibu near Topanga Canyon) and also in the south San Fernando Valley (below the 101). Still, its great to see a bit more 'on-the-street' data about L.A in general.

My - very unscientific - view:

the ony things going in Malibu under 1 million are the horrible Heathercliff Rd 'mobile homes' - which continue to sit on the market, minimum price about 500K, and the Paradise Cove MHs, ditto. Being just off the PCH, and a good 20 miles down the road from Santa Monica, I think they'll continue to sit and sit...

Topanga - lots of very expensive houses (1 -3 million), some of which have been sitting for almost a year. Checking asking prices against Zestimates show that some are priced at over 1 million above thier Zestimate (I know, the Zestimates are not very accurate, but they do at least give a 'ballpark' figure). Also the 'Top 'O Topanga' complex has many, many houses on the market, again, many not moving for months.

Pacific Palisades - not much there below 1 million, and Zestimates show that prices are still rising. Eh?

Santa Monica is still a joke. Usual asking price for a sub-1000ft SHR with a 3000 ft lot is around 750K. Not much in the way of price reductions yet.

I guess its going to be while yet before any real reductions show up. The more northerly beach towns were always the most 'toney' and I'd guess that many owners there will not feel the pinch quite as badly, or as suddenly as other less affluent places.

Still, its good to hear what's going on. Maybe next year, we can finally buy something. we've been in LA since 2000 (moved from the UK for work) and depite making well above median salary, we've always been chasing the ladder up, so to speak. Just when we'd saved enough to do a downpayment, the prices would soar again, and we'd be priced out.

I would not be in too much of a hurry to buy something, especially around here. Last time we had a real estate downturn the real estate markets here started caving in around 1989-1990 and didn't really bottom until well into 1995, almost 1996. There was at least 6 years worth of declines. People who bought a year or two into it ended up screwed. And we have every reason to believe that this time around could be much much worse.

Even if you think you can buy something and then weather a continuing downturn, neighborhoods change or circumstances can change where you might really feel forced to move, for your safety, your sanity, or whatever. It's impossible to extract the equity out of your house when the perceived value of your property has declined well below what you paid for it, so that equity would be kissed goodbye. Thinking you can weather a severe downturn is like gritting your teeth through a stock market plunge and swearing to hold on for the long haul. Unfortunately downturns in asset markets can last longer than most people can stay solvent.

When a neighborhood has been through a vicious decline its character can change dramatically to something you had not anticipated.

Post a Comment

<< Home