L.A. Times: Home Sales Fall Again, Prices Rise

There isn't much new information in this July 19 L.A. Times story by bubblewatcher Annette Haddad that hasn't already been reported.

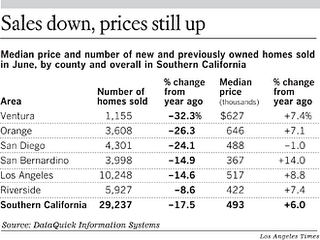

The article notes that only 11% of Southern California households are able to afford median-priced housing using conventional mortgages. The rise of nontraditional mortgages are one of the key reasons cited for the continuing rise in home prices.

And, on a sour note, the article does suggest that the declining demand could "foreshadow" falling prices. A local MLS listing service covering Los Angeles reports that it has more homes listed now than at any other time in its history, and that the time to sell is double what it was a year ago.

In terms of inventory and the pace at which it is being sold, it would take 5.2 months to move all the current inventory. In late 2004 it was 2.5 months. In the mid-1990s, toward the end of our previous housing bear market, it was 19 months.

Some realtors have been saying we are reverting to a more "normal" market and offer as a "bear market" metric a potential 9 to 10 month supply of inventory on the market before "getting nervous".

Finally, one buyers agent states there are many scared buyers out there, who are afraid to buy "because they think prices will drop".

So now that the San Diego market has reached a (negative) milestone, we are just barely beginning to see some speculation in the real estate news that prices will decline. Such insight would have been far more helpful to potential home sellers in the spring of 2005 while the markets were still hot. It does not pay to listen to the Wall Street, Washington, economic, or real estate professionals when it comes to your financial safety, because their insights normally come after a trend has changed, when it may be too late to be helpful. It pays to look ahead.

0 Comments:

Post a Comment

<< Home