Other measures of Beach Cities market activity, July 2006

Shorewood Realtors has graciously provided their latest report numbers for July.

We notice that the moving average of average days on market (DOM) for the beach cities for all townhomes, condos, and SFRs sold in July remains pretty level at 36. The shape of the graph tends to spike up around New Year's, when the sales season is traditionally slow, and tends to come down into the spring and summer months, rising very slightly into summer. So far, we haven't seen a big leap here yet. Unfortunately, DOM is a number that can easily be manipulated, because listings expire and relist, disguising the problem of some homes being on the market for many many monts! Is DOM manipulation so pervasive now that it tells us nothing? We'll know the answer to that if this autumn we continue to see the market deteriorate as rapidly as it has been by other measures, but DOM does not budge.

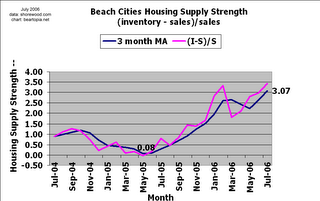

How about our own measure of Supply Strength (our PC term for demand weakness)? That seems to be pressing steadily upward. In June the 3 month moving average was 2.63, for July it's at 3.07. You Elliott Wavers out there, is that a nice five waves up from May 2005 (with 5th wave the longest), with a brief sharp correction, then resumption of the trend?

Supply strength, along with real estate $$$ volume transacted, have shown themselves to be very good leading indicators of a trend change in our local real estate markets. Notice how the supply strength was extremely close to 0 in the May-June 2005 timeframe. That was probably a sign of a market peak. From there, the trend has pushed up. Too bad this wasn't known over a year ago as it might have helped some wary homeowners to pick the right time to sell!

You'll be seeing the August real estate $$$ transacted charts this Labor Day weekend.

1 Comments:

These charts are only for the "big four" beach cities: El Segundo, Manhattan Beach, Hermosa Beach, and Redondo Beach.

Post a Comment

<< Home