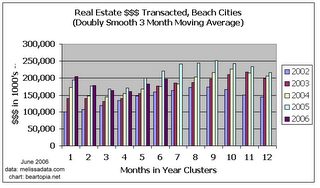

Real Estate $$$ Transacted through June 2006 for Beach Cities

2006 is half over, and the pin has not arrived yet, though it may be getting closer. The beach city real estate markets are overall seeing a slow leak, but some of the surrounding areas are booming. Buyers are dragging their feet buying in the beach cities but (perhaps out of desperation) buying in surrounding areas.

For new visitors, be sure to visit our real estate $$$ tracker. Instead of graphing average sale prices, which you typically see in the local beach papers, we take total number of sales in a zip code and multiply it by the average sale price. You will find a more detailed explanation at the link.

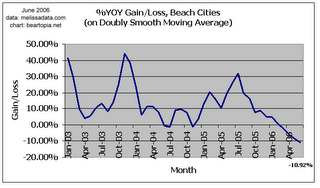

For new and returning visitors. This month, the YOY charts show the percentage figure up or down in the lower right of the graph. That reflects the YOY value on the doubly smooth 3 month moving average for June. For example, for 90278 it is -16.85%.

El Segundo (90245) underwent a burst of glory in June after suffering slight malaise in March, April and May. Manhattan Beach (90266) is flattening. Hermosa Beach (90254) had a decent April and is showing a bounce in its YOY trendline, but remains below 0%. South Redondo (90277) is exhibiting the most damage in its market, and North Redondo (90278) is probably #2 in damage.

As you can see from the %YOY Gain/Loss chart for the beach cities, it's been a steady downward slide since July 2005 (one year ago), and we have yet to see a price meltdown.

Real estate $$$ are leaking out of 90034 (Palms), 90064 (Rancho Park), 90066 (Mar Vista), 90232 (Culver City), 90250 (Hawthorne), 90254 (Hermosa Beach), 90266 (Manhattan Beach), 90277 (south Redondo Beach), 90278 (north Redondo Beach), 90291 (Venice), 90293 (Playa del Rey), 90503 (Torrance), 90504 (Torrance), and 90717 (Lomita), as indicated by the %YOY Gain/Loss on the doubly smooth 3 month moving average.

90230 (Culver City) has been drifting along right at the 0% line on the YOY chart, not showing a move either way.

90094 (Playa Vista) and 90292 (Marina Del Rey) are still extremely strong. 90502 (Torrance) is trending down but still a long way from 0% YOY. 90045 (Westchester) has rebounded back over 0%. 90245 (El Segundo) is hanging on above 0%, as is 90260 (Lawndale). 90501 (Torrance) is trending down and about to hit 0%. 90505 (Torrance) is back above 0%.

This month, we added five zip codes for Inglewood (90301-90305), and with good reason. A big community redevelopment effort called Inglewood Renaissance has sucked in major dollars. Homes that developers originally thought they were going to offer in the $400,000's are now in the $600,000's due to an enormous amount of interest. Zip codes 90301, 90302, 90303, and 90305 are flying, while 90304 is moving steadily down toward 0% but still above it. Come to think of it, I believe Fusion at South Bay was also initially priced in the $400,000's at the low end, but they are now starting at $517,000. These homes, by the way, are in 90250 (Hawthorne), right across from Manhattan Beach.

It's difficult to say what lies ahead. I honestly cannot envision a meltdown in the beach cities without a meltdown in the surrounding areas that are currently booming. When a huge credit bubble bursts, I doubt there will be islands of safety around here. The unwinding is sure taking a heck of a long time to build up momentum, though.

2 Comments:

Fusion at South Bay is on the east side of Aviation Blvd just north of Marine, next to the Green Line railyard.

Inglewood Renaissance is near Hollywood Park and the Forum, east of Prairie, north of Century. Florentia is built by MBK Homes. The Aria development by John Laing homes is already sold out.

The Fusion condos (which I drive by every morning) remind me of sardine packing, but the Inglewood homes are substantially nicer - just my opinion. Some pictures of Inglewood Renaissance can be found here:

http://www.lasvegasbuyeragent.com/california/inglewood-renaissance.html

http://www.mbkhomes.com/communities/florentia/

I think only the builders of either Inglewood Renaissance or Fusion would know how many interested buyers intend to occupy their units themselves.

My gut feeling is that everything will sink, but there is no denying that places like Inglewood (and Torrance, which also has some large "affordable" housing projects going on), are at the moment doing better than, say, Redondo Beach. I don't know if that means that buyers interested in Redondo Beach have given up on Redondo Beach and have chosen to buy in Inglewood or Torrance instead - they would have to be asked.

I know if I were in the market and really wanted to own, I'd be looking at these other places instead of Redondo Beach. And I am not what you'd consider the typical Inglewood income either, but I'd want my mortgage dollars to go as far as possible.

We're currently experiencing the calm before the storm. Increasing ARM resets in a rising interest rate environment combined with a slowing economy and a "new psychology" will bring prices down 30-40% from peak prices over the next several (3-5) years. No area, including the beach cities, will be spared from this correction.

Oh, BTW, a "crash" or "bust" in real estate takes years...not months. I'm a little dissapointed in the media's failure to grasp this concept. The economy doesn't go from boom to bust in a few months, and an asset market as big as residential RE doesn't either.

Bearmaster will have this blog going for years in order to follow the market to the bottom.

Post a Comment

<< Home