Los Angeles Beach Cities Resale Activity for September 2007

According to Dataquick, southland home sales were at their lowest level in September in more than 2 decades. Jumbo financing declined more than 50%.

The Southland sold 12,455 new and resale SFRs and condos in the 6 county region in September. The prior most recent low was February 1995, with the sale of 12,459. September sales were down 30% from August, and down 48.5% YOY.

The median Southland price for a home was $462,000, down 4.0% YOY and down 7.6% from August. Analysts figure that even if jumbo financing had remained stable, the median would have been around $487,000.

The monthly mortgage payment commitment that buyers took on was $2,198, down from August's $2,422, and down from $2,295 from September 2006. Foreclosure activity remains pinned at record levels, ARM financing is flat, multiple mortgage financing has plummeted, down payment sizes are stable, non-owner occupied activity and flip rates are flat, according to Dataquick.

Here are the All Home Sales figures for Southern California:

County Sales Sales % Chg Median $ Median $ % Chg

Sep 06 Sep 07 YOY Sep 06 Sep 07 YOY

Orange 2919 1643 -43.7% $630,000 $570,000 -9.5%

Los Angeles 8636 4361 -49.5% $519,000 $525,000 +1.2%

Riverside 4730 2208 -53.3% $421,000 $375,000 -10.8%

San Bernardino 3437 1509 -56.1% $365,000 $325,000 -11.0%

San Diego 3336 2152 -35.5% $485,000 $470,000 -3.1%

Ventura 1137 582 -48.8% $592,500 $545,500 -7.9%

Here in Los Angeles County, the RESALE median for SFRs was $565,000, +3.7% YOY. Resale median for condos was $425,000, +4.2%.

Here are the L.A. County and beach city zip code charts.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SFR MEDIAN %YOY CONDO MEDIAN %YOY

COMMUNITY ZIP SALES SFR CHG SALES CONDO CHG

LA/Westchester 90045 23 $820 +2.6% 0 N/A N/A

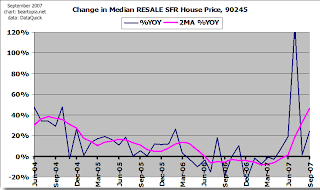

El Segundo 90245 6 $845 +24.3% 1 $540 +2.9%

Hawthorne 90250 18 $485 -8.3% 3 $310 -26.0%

Hermosa Beach 90254 7 $1,287 +25.0% 2 $661 -38.3%

Lawndale 90260 5 $500 -8.7% 4 $361 -17.7%

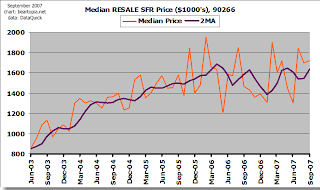

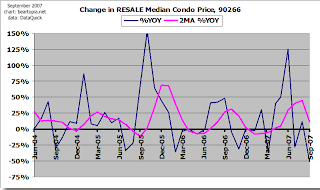

Manhattan Beach 90266 24 $1,720 +17.4% 1 $840 -50.6%

Palos Verdes Pen. 90274 22 $1,373 -8.5% 7 $440 +26.8%

Rancho P.V. 90275 21 $1,130 -2.0% 6 $643 +11.2%

Redondo Beach 90277 16 $1,033 +17.0% 16 $809 +14.3%

Redondo Beach 90278 20 $728 -5.3% 9 $773 +15.4%

Long time blog readers know that I take issue with the way these numbers are reported. With types of sales broken out into zip codes, the numbers end up being too small to truly get statistically significant trend information. The numbers for L.A. County and the Southland in general are the most meaningful. Los Angeles County still floats on layer of helium and hemp smoke, though median price momentum is slowing. What's going on in the beach cities is due more to the narrowing of activity in higher-end homes.

1 Comments:

I'm not sure how the wildfires will effect the housing markets. There are lots of idiots out there who think that destroying property is a good thing, economically, due to the allocation (or rather, misallocation) of resources that would have been better directed to something else. While housing supply will be reduced, are buyers are going to have second, third, and fourth thoughts about living in such fragile areas??

Guess it depends on just how bearish buyers feel at the moment. We had bad fires in 2003 but the market was booming during the time and the market just kept booming afterwards. Resources allocated to reconstructing homes in San Diego were easily absorbed into the general housing market. Now, we are still early in a bear market, so psychologically we're at a different place. The "we will build again" mentality of the boom could now be "let's get the hell out of here" mentality of the bust.

New listings are still pouring on to Redondo inventory at a moderate pace, roughly 2.7 new listings per day for this month. I'm still very frustrated by the lack of updates in Zillow. It's been very hard gaging what's going on - though I have noticed a few For Rent signs springing up on a few properties where sellers are refusing to lower price any further.

Post a Comment

<< Home