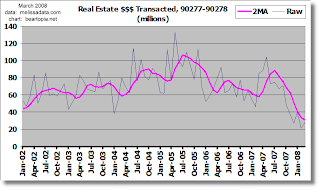

Los Angeles County South Bay Beach Cities Real Estate $$$ Transacted for March 2008

Believe it or not, the housing market is registering a pulse. I think housing sales are finally starting to pick up a bit, but in light of what has happened to the mortgage markets in recent months, I have no way to estimate how far a bounce will go. My client that works in mortgage at Wells Fargo is still busy and I fully take her word for it.

The FHA flyer that landed on my apartment doorstep the other day scared me. I call that FHA loan program "subprime + 5%", because for Redondo Beach prices they will probably want 5% down, but with few questions asked, such as, "Where is the money coming from?!?" If falling knife shoppers come flooding into this market, then we'll see more of the same problems a few years down the road when the FHA loans cave in. But then again, we'll see more problems even without these subprime + 5% loans, courtesy of our government and your tax dollars, so I'm really flying blind here. It's the market of the damned.

I find it somewhat ironic that at this point we really NEED a bounce, to get some of this unsold inventory with its history of price cuts finally sold off and marked to market. At least more sales will give us a better idea of where price levels really are, instead of leaving us just guessing.

For the most part, I'm seeing deep and frequent price cuts in unsold inventory, but a few sellers are still raising asking prices, anticipating a resurgence of the brisk housing market during the glory days of 2004-2006.

You can view a particular zip code through my regional tracker, and also my Google map tool.

YOY Comparisons

These numbers are a YOY comparison of the doubly smooth moving average of dollar volume charts. I think of them as "recent pain" (or recent gain) indicators.

Property sales and their realtors still on steroids... 90094 177.4% Playa Vista Doing OK 90064 2.0% Rancho Park/Cheviot Hills 90501 1.7% Torrance "I fell down down down in a burning ring of fire..." 90245 -7.3% El Segundo 90254 -12.4% Hermosa Beach 90293 -13.5% Playa del Rey 90045 -17.6% Westchester 90291 -17.8% Venice 90505 -22.1% Torrance 90034 -24.1% Palms 90292 -25.5% Marina del Rey 90401-90405 -27.2% Santa Monica combined 90056 -30.8% Ladera Heights 90504 -32.8% Torrance 90275 -35.5% Palos Verdes Estates 90501-90505 -35.9% Torrance Combined 90036 -36.7% Park La Brea beach cities -37.4% 4 Beach Cities combined 90066 -38.7% Mar Vista 90277 -41.2% Redondo Beach (south) 90266 -41.7% Manhattan Beach SW county -43.1% Southwest L.A. County 90717 -44.2% Lomita 90232 -45.3% Culver City 90732 -45.3% San Pedro/Rancho PV 90277-90278 -46.6% Redondo Beach combined 90016 -49.0% West Adams 90008 -49.0% Baldwin Hills / Leimart Park 90278 -50.3% Redondo Beach (north) 90035 -50.6% West Fairfax 90301 -52.8% Inglewood 90746 -55.3% Carson 90230 -56.0% Culver City 90019 -56.3% Country Club Park/Mid City 90007 -56.7% South Central 90043 -57.4% Hyde Park, Windsor Hills 90503 -61.5% Torrance 90250 -61.6% Hawthorne 90260 -61.6% Lawndale 90249 -62.5% Gardena 90247 -62.6% Gardena 90018 -62.7% Jefferson Park 90302 -63.7% Inglewood 90502 -63.7% Torrance 90062 -66.4% South Central 90745 -67.2% Carson 90044 -67.5% Athens 90047 -67.6% South Central 90731 -70.0% San Pedro 90301-90305 -70.9% Inglewood/Lennox combined 90304 -73.0% Lennox 90037 -76.0% South Central 90305 -82.4% Inglewood 90303 -82.9% Inglewood 90744 -142.3% Wilmington

Relative Strength

This is a longer-term view of the strength of dollar volume in a given zip code. For this month 5.3 is the strongest (suffering the least amount of chronic pain) and -1.0 being the weakest (suffering the most chronic pain). Think of it is as the area above 0 on the YOY graph with the area below 0 of the YOY graph subtracted out.

90094 5.3 Playa Vista 90247 3.1 Gardena 90305 2.7 Inglewood 90034 1.7 Palms 90044 1.7 Athens 90746 1.4 Carson 90292 1.4 Marina del Rey 90047 1.0 South Central 90062 0.9 South Central 90301-90305 0.9 Inglewood/Lennox combined 90304 0.9 Lennox 90007 0.9 South Central 90502 0.9 Torrance 90018 0.8 Jefferson Park 90016 0.7 West Adams 90301 0.7 Inglewood 90293 0.7 Playa del Rey 90745 0.7 Carson 90250 0.7 Hawthorne 90302 0.7 Inglewood 90501 0.7 Torrance 90303 0.7 Inglewood 90732 0.6 San Pedro/Rancho PV 90064 0.6 Rancho Park/Cheviot Hills 90043 0.6 Hyde Park, Windsor Hills 90037 0.5 South Central 90019 0.5 Country Club Park/Mid City 90008 0.5 Baldwin Hills / Leimart Park 90254 0.5 Hermosa Beach 90291 0.5 Venice 90045 0.4 Westchester 90230 0.4 Culver City 90503 0.4 Torrance 90249 0.4 Gardena 90036 0.4 Park La Brea SW county 0.4 Southwest L.A. County 90260 0.3 Lawndale 90245 0.3 El Segundo 90501-90505 0.3 Torrance Combined 90232 0.3 Culver City 90278 0.3 Redondo Beach (north) 90066 0.3 Mar Vista 90731 0.3 San Pedro 90401-90405 0.2 Santa Monica combined 90505 0.2 Torrance 90277-90278 0.2 Redondo Beach combined beach cities 0.2 4 Beach Cities combined 90056 0.1 Ladera Heights 90266 0.1 Manhattan Beach 90035 0.1 West Fairfax 90717 0.1 Lomita 90277 0.1 Redondo Beach (south) 90504 0.0 Torrance 90275 -0.1 Palos Verdes Estates 90744 -1.0 Wilmington

2 Comments:

Question...Doesn't FHA have stricter financing guidelines than other non government programs? Meaning, a maximum of 35% of buyer’s gross income can go towards monthly mortgage payments? So, I would say that most people cannot afford a home in the South Bay.

Nope! Not according to my previous post on the subject. The flyer I got the other day titled "FHA as an Option" clearly states "No income limit", "No FICO score requirement." That's why I call it "subprime + 5%", because they want as much as 5% down because of Redondo Beach prices but they are not asking too many questions about where the money comes from.

FHA is "insuring" the lenders by collecting premiums from the buyers, I don't see how the premiums will offset the potential losses.

I am not joking.

Post a Comment

<< Home