Los Angeles Beach Cities Resale Activity for May 2008

The DataQuick median price statistics for existing homes are my least favorite statistics for the housing market because they mislead people into thinking there is something sacrosanct about the median prices that they publish when broken down by zip code and housing unit type. And nothing can be further from the truth.

How can you conclude from the sale of one condo in the Palos Verdes Peninsula area that the median price of a condo in that area has appreciated +53% in one year? The answer is: you can't. Nor can you conclude that the median price of a condo in Manhattan Beach is now down -28% in one year, based on the sale of two condos. There simply isn't enough sale data here to conclude anything about the condominium markets in those areas.

Consider this. In some recent months in some areas, NO units have been sold. So by logical extension, the median price should be reported as ZERO. That's much too scary a thought for the masses to handle, so the paper simply reports a N/A when 0 sales occur.

By now it should be clear that median sale price has meaning only when there are sales, and there are enough sales to be representative of the general population of potential homes for sale, but it still has a rather tenuous meaning. If we sold only high-end luxury homes last year and then sold mostly 1 bedroom senior condos this year, we're comparing diamonds to iron ore. Naturally the median price of rocks sold will plummet. It works the other way too. You tear down the old iron-ore postwar houses and erect bloated diamond bubbleminiums, then the median price will zoom. That was going on here for years, during the good old bubble days. So we have not had sales that are good representative samples of the entire population of homes for sale.

The only way I would trust a median price measurement around here would be to crawl into a time machine and take a set of homes, say, back in 2000 and sell them. Make sure you've got a good mix of diamond homes and iron ore homes and everything in between. Maintain them, but don't remodel them by expanding their square footage. Now sell that same set of homes every year in 2001, 2002, 2003 and so forth, all the way up to the present. What are those original homes worth now?

What many people don't realize is that sales volume in the beach cities was gradually starting to descend here even during the bubble days. It wasn't yet a problem for the industry because the industry pros were collecting fatter commissions due to the higher commanding prices of all those diamonds. Dollar volume transacted was continuing to climb ever higher and that did not peak until about three years ago. Coincidentally, the ratio of inventory to sales (I-S)/S) was at its tightest ever, hitting zero at about that same time dollar volume peaked. It's been well above zero ever since.

Inventory to sales; dollar volume; history of asking prices; price reduction percentages - these are some of the trends I follow regularly on this blog. I think this additional information gives you many more pieces of the housing market puzzle. If my dataset is so small as to risk statistical validity, I try and point that out.

Speaking of local papers, the Manhattan Beach Reporter has fumbled their home sales report for two weeks in a row now. Last week, the paper reprinted the home sales from the prior week. An email from the paper said they'd fix it this week. So what happens this week? The paper didn't report home sales at all. I don't know yet how I am going to track June sales if the paper won't come through.

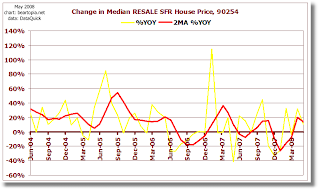

Having said that, here are the May charts of median prices on existing homes sold. The only charts that have validity are the Los Angeles County charts. But they aren't very helpful in determining what your neighbor's house might be worth, today.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Here are the detailed RESALE statistics for the beach cities and some of the surrounding zip codes (prices are in 1000's):

SFR MEDIAN %YOY CONDO MEDIAN %YOY

COMMUNITY ZIP SALES SFR CHG SALES CONDO CHG

LA/Westchester 90045 15 $777 -4.4% 2 $333 0.0%

El Segundo 90245 13 $695 -18.2% 7 $550 -0.9%

Hawthorne 90250 20 $402 -26.4% 2 $300 -29.1%

Hermosa Beach 90254 6 $1,018 +10.1% 3 $1,170 -0.8%

Lawndale 90260 5 $447 -18.4% 1 $430 -0.9%

Manhattan Beach 90266 26 $1,411 -2.9% 2 $1,135 -28.8%

Palos Verdes Pen. 90274 26 $1,440 -7.2% 1 $590 +53.2%

Rancho P.V. 90275 27 $1,137 +3.8% 9 $540 -8.0%

Redondo Beach 90277 12 $1,090 +5.3% 27 $663 -17.6%

Redondo Beach 90278 21 $739 -4.1% 14 $645 -4.4%

5 Comments:

This is what I heard from Manhattan Beach Reporter when I asked if they were planning to discontinue showing home sale data.

"As newsprint has become more expensive (up 18% this year) we have

had to cut back pages when we can. We chose not run it this week because we

needed the space for open houses, but we will run it from now on."

Right now during June 2008, the home sale rates for Hermosa Beach and Manhattan Beach appear to very sluggish compared to June 2007. El Segundo is comparable to last year in terms of home sales, north Redondo also looks comparable.

But south Redondo looks like it's having a fire sale. For 90277 I think sales volume and dollar volume transacted will exceed June 2007 sales volume. Well we definitely need to clear out some inventory down there and get some of these price cuts realized on the market.

I should add, for 90277, at the current rate of home sales I am guesstimating that the total number of sales will be about 41 for June. That's up from 29 in June 2007. However, average sale price is currently down nearly 22%, from $914,000 to $714,000. The home selling industry will be "making it up on volume" this month.

What you are describing is basically the Case-Shiller methodology.

Hi Jim,

Yes that is true, though I think Case-Shiller excludes condominiums and looks only at single family residences.

People are riveted to median price as if it were the magic 8 ball oracle. There are potentially so many other more reliable measures of market health and activity that ought to be published in the papers, but aren't.

Post a Comment

<< Home