Daily Breeze: High-end homes lagging

Muhammed El-Hasan at the Daily Breeze regularly writes business news, and he's keeping tabs on the South Bay housing market. Let's see what he's saying right now in this June 28 article (link may expire).

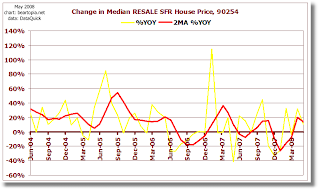

The South Bay's real estate market had been relatively insulated from the worst of the region's downturn. That changed in the past two months, with the median price of a single-family home sold in May at $675,000, down 6.6 percent over May of last year, according to the South Bay Association of Realtors, which released a housing report Friday. In April, the median price dropped 10.6 percent, year over year, to $625,000, the association said. The association's figures represent the South Bay, excluding the Palos Verdes Peninsula and Inglewood, which have their own real estate associations. The median is the middle price in which half of homes sold for more and half for less. Changes in home prices and sales volume often are calculated year over year to account for seasonal trends. "The downturn in the real estate market over the past 18 months has hit many areas of Los Angeles County very hard," said Carol Olney, the association's president, in a statement. "As has been the case in other declining markets, real estate in the South Bay remained somewhat insulated from the depreciation experienced in these other areas. This changed, however, over the past two months." The sales volume also dropped significantly. The median price for a single-family home was down 22.8 percent year over year in May, with an annual drop of 36.3 percent in April, the report says. Previously, home sales in high-end neighborhoods had helped prop up the median price. That was because high-priced home sales did not fall as severely as sales in the less expensive inland areas. But April and May brought a greater slump at the high end, as the low-end and midrange markets began to see sales improve because of a boost in federally-insured mortgage limits and the nation's economic stimulus package that provided tax rebates, Olney said in a followup interview. In addition, since the low-end market has seen a more severe drop in prices, homebuyers now see those houses as a better bargain, she said. "Putting them together, it means that the lower end of the market has life again," she said. High-end homes are still helping to prop up the local housing market, Olney said. This dynamic is seen in a telling statistical disparity in which the average sales price for a single family home was much higher than the median, for both May or April. For condominiums and townhouses, the change in sales volume showed a huge disparity between May and April. For May, condo and townhouse sales "showed no change" compared with May of last year, the report says. But that market saw a severe year-over-year drop of 53 percent in sales in April. The median price of a condo and townhouse in May fell only 2.1 percent to $563,000. The median for April fell 3.9 percent to $537,000. Changes in federal mortgage insurance policies also help explain the May improvement for condos and townhouses, Olney said. Also, many homebuyers see condos and townhouses as a better deal because they are less expensive per square foot than houses and are often newer, Olney said. "Condos are so much stronger, which is really unusual. In every other down market, single-family homes have kept their value better than condos," Olney said. muhammed.el-hasan@dailybreeze.com

You can also find Muhammed at Inside So Cal Biz Waves.