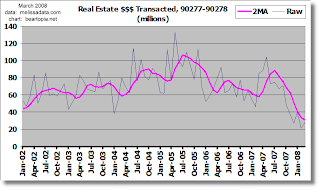

Other measures of Los Angeles beach cities market activity, March 2008

Shorewood has published March statistics.

According to Shorewood, March average DOM for sales in the four beach cities was 62, which I note is the highest DOM for March since I've started keeping track of Shorewood's DOM numbers back to July 2004. Take a good look at this DOM chart, because it's showing an unusual pattern here that shows DOM climbing instead of falling at this time of year. Hello! This is like a train running off its rails.

By the way, my calculation of a more realistic average DOM for Redondo Beach for March came in at 151 days.

Now let's look at Supply Strength (Demand Weakness). The most recent new high was January, but it's come down a little off that and it is still very high. In terms of inventory relative to sales, this market reached its apex in the late spring of 2005 and it's been deteriorating from there.

If inventory keeps piling on, this will stay pegged relatively high. If sellers give up and wait for the market to recover before trying to sell again, I expect this to come down. I would not expect it to sink lower than, say, 2.5. But we know darn well that this shows only the official inventory, it does not show that overhanging psychological inventory of the sellers I mentioned that want to sell but gave up. If it sinks to 2.5 without a commensurate big surge in sales, then we'll know sellers are pulling their homes off the market.

For the record, beach cities sales for March were 82, down from 222 in March 2007. Inventory was 641, up from 493 in March 2007.

And finally, median sale price for the beach cities for March was $970,000, up +4.3% YOY. The jump in median doesn't show us that NOTHING sold for less $500,000 in March, whereas 7 properties were sold in that range a year ago. Although sales are down substantially in all price categories, from looking at Shorewood's numbers, it looks like there is more inventory in the lower price ranges relative to a year ago than inventory in the higher price ranges relative to a year ago. It's the same old story - the affluent buyers who might be able to write a check for the new house are what are keeping this market afloat. There has been a shift in composition as well as a significant decline in sales volume, and we aren't comparing apples to apples here.

So what does Shorewood say about what looks to me like evidence of a market that has deteriorated and hasn't recovered its strength?

The rise in median price "Further demonstrates the beach area’s continued desirability as well as its relative immunity from forces buffeting other markets."

Let's file that sentiment carefully away and revisit it periodically.