I am going ahead and publishing June data early. If I have to make corrections to it, I will do so when I publish July charts.

Over the past month we've been hearing a great deal about slowing sales. Some parts of the area I cover (south of the 10 freeway, west of the 110) are indeed getting hit, in terms of sales volume and real estate $$$ transacted. But some areas haven't been paying attention to the headlines and are struggling to continue along the path of the spring bounce.

I have to agree with observers who say this market is very lopsided. Most of the upper-end areas are hanging in there and their markets are doing relatively well compared to mid and lower tier market areas. That's not to say that they are blasting to new highs - nope, not at all. Only Playa Vista (90094) is one area I would say is showing renewed enthusiasm. There must be a new development on line and up for sale.

If the party is over in the beach cities, some guests are still lingering to sip the dregs of the punch bowl and turn off the lights. At least that's what it looks like on the surface. It's very difficult at this stage to determine what portion of the sales listed are due to some kind of financial distress. Right now I show two June Redondo Beach sales that were definitively some kind of distress sale, as they were due to be auctioned in July. I have six June sales (including the two mentioned) marked as "suspicious". Some are because of the proximity of recent transactions on that same property. Out of these six, one is marked a short sale. That's out of 46 actual sales that I've managed to record for June thus far, but Melissa Data says there are 88 sales for Redondo Beach for June, so there is much that remains unknown.

Another problem making it difficult to track what's going on is the way that Zillow shifts sales dates. When a sale is first recorded in Zillow, sometimes the date gets shifted later on. I've seen late May sales get shifted into June, for instance. Sometimes records just disappear altogether. And if you've looked at Zip Realty lately, it's a mess. I've lost count of the number of Redondo Beach properties for which it has double entries. I have no perspective from the inside, but as an observer, I'd say the bookkeeping aspects of this housing market are in chaos. Time will tell if that signifies that the underlying markets are also in a chaotic condition.

Anyway, back to the June sales. Of the four beach cities, only Hermosa Beach (90254) appears to have taken anything like a good leap upward in June. El Segundo, Manhattan Beach, and Redondo Beach have not turned downward, but don't appear to be energetically climbing upwards either. Palos Verdes Estates (90275) looks quite weak this month.

Perhaps the best area that reflects what's going on in the upper westside areas is Rancho Park (90064). Take a look at its graph. Notice how long the %YOY trendline remained below 0% and how deeply it cut below 0%, then notice the sharp quick recovery bounce, and how the YOY trendline is starting to turn down again.

Many of the areas you would expect to get hit are indeed getting hit. Inglewood has slumped bigtime. (The Wikipedia page for Inglewood Renaissance no longer exists.) Areas of south central are slumping.

Here are the charts for Redondo Beach, the beach cities, and the area of southwest Los Angeles County that I cover.

Here are the %YOY rankings. As a reminder, the numbers are on the 3 month doubly smooth moving average of the %YOY change in dollars transacted. This number is a more "immediate" measure of what is happening. If you look up the individual zip codes in our tracker, you'll see the trendline of this number.

MONTHLY PAIN

Realtors currently fat and happy

90064 28.9% 0.3 Rancho Park/Cheviot Hills

90277 23.4% 0.1 Redondo Beach (south)

90503 16.7% 0.6 Torrance

90094 15.8% 4.3 Playa Vista

Doing well

90277-90278 12.0% 0.3 Redondo Beach combined

90293 9.4% 0.6 Playa del Rey

90066 6.1% 0.4 Mar Vista

90732 5.4% 0.8 San Pedro/Rancho PV

beach cities 5.1% 0.3 4 Beach Cities combined

Doing OK

90278 4.8% 0.5 Redondo Beach (north)

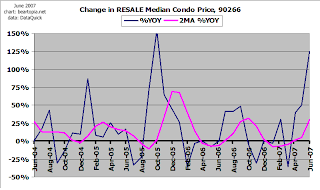

90266 2.2% 0.3 Manhattan Beach

90304 1.6% 1.3 Lennox

90254 1.4% 0.3 Hermosa Beach

90505 0.0% 0.3 Torrance

Hanging in there

90034 -0.5% 1.9 Palms

90501 -1.4% 0.9 Torrance

90036 -3.0% 0.5 Park La Brea

90275 -3.4% 0.1 Palos Verdes Estates

Slip sliding away

90250 -7.5% 1.1 Hawthorne

90230 -8.6% 0.8 Culver City

90245 -9.6% 0.6 El Segundo

90501-90505 -11.6% 0.6 Torrance Combined

90291 -15.5% 0.5 Venice

90045 -16.3% 0.5 Westchester

SW county -16.8% 0.6 Southwest L.A. County

90717 -17.7% 0.5 Lomita

90249 -19.7% 0.9 Gardena

90401-90405 -23.2% 0.4 Santa Monica combined

90056 -23.6% 0.6 Ladera Heights

90043 -24.3% 1.1 Hyde Park, Windsor Hills

About to head off a cliff

90018 -31.6% 1.4 Jefferson Park

90007 -31.9% 1.3 South Central

90504 -33.3% 0.4 Torrance

90044 -33.5% 2.2 Athens

90062 -36.1% 1.5 South Central

90035 -36.2% 0.5 West Fairfax

90047 -37.1% 1.5 South Central

90008 -38.0% 0.7 Baldwin Hills / Leimart Park

90019 -38.3% 0.9 Country Club Park/Mid City

90260 -38.9% 0.9 Lawndale

90292 -39.3% 1.7 Marina del Rey

90016 -39.7% 1.2 West Adams

90232 -43.3% 0.6 Culver City

90746 -46.2% 2.0 Carson

90037 -46.3% 1.2 South Central

90745 -47.5% 1.3 Carson

90301 -49.8% 1.3 Inglewood

Down the cliff, Thelma and Louise style?

90303 -53.0% 1.3 Inglewood

90744 -55.0% 0.6 Wilmington

90502 -55.6% 1.5 Torrance

90301-90305 -61.1% 1.6 Inglewood/Lennox combined

90302 -70.0% 1.3 Inglewood

90305 -77.5% 3.5 Inglewood

And here are the zip codes sorted according to the more chronic pain they feel. Remember that the higher this number, the less chronic pain the zip code feels. The closer to 0, the more chronic pain this zip code feels. At the top is Playa Vista, which hasn't felt much pain from any downturn. Inglewood is near the top. Despite its sharp slump, that slump is relatively recent. The beach cities are near the bottom, which, despite their relatively recent bounces, have felt some pain from the slump.

LONG TERM PAIN

90094 15.8% 4.3 Playa Vista

90305 -77.5% 3.5 Inglewood

90044 -33.5% 2.2 Athens

90746 -46.2% 2.0 Carson

90034 -0.5% 1.9 Palms

90292 -39.3% 1.7 Marina del Rey

90301-90305 -61.1% 1.6 Inglewood/Lennox combined

90047 -37.1% 1.5 South Central

90502 -55.6% 1.5 Torrance

90062 -36.1% 1.5 South Central

90018 -31.6% 1.4 Jefferson Park

90303 -53.0% 1.3 Inglewood

90302 -70.0% 1.3 Inglewood

90304 1.6% 1.3 Lennox

90301 -49.8% 1.3 Inglewood

90745 -47.5% 1.3 Carson

90007 -31.9% 1.3 South Central

90016 -39.7% 1.2 West Adams

90037 -46.3% 1.2 South Central

90250 -7.5% 1.1 Hawthorne

90043 -24.3% 1.1 Hyde Park, Windsor Hills

90249 -19.7% 0.9 Gardena

90019 -38.3% 0.9 Country Club Park/Mid City

90260 -38.9% 0.9 Lawndale

90501 -1.4% 0.9 Torrance

90732 5.4% 0.8 San Pedro/Rancho PV

90230 -8.6% 0.8 Culver City

90008 -38.0% 0.7 Baldwin Hills / Leimart Park

90232 -43.3% 0.6 Culver City

90501-90505 -11.6% 0.6 Torrance Combined

90744 -55.0% 0.6 Wilmington

90503 16.7% 0.6 Torrance

90245 -9.6% 0.6 El Segundo

SW county -16.8% 0.6 Southwest L.A. County

90293 9.4% 0.6 Playa del Rey

90056 -23.6% 0.6 Ladera Heights

90045 -16.3% 0.5 Westchester

90291 -15.5% 0.5 Venice

90036 -3.0% 0.5 Park La Brea

90035 -36.2% 0.5 West Fairfax

90278 4.8% 0.5 Redondo Beach (north)

90717 -17.7% 0.5 Lomita

90066 6.1% 0.4 Mar Vista

90504 -33.3% 0.4 Torrance

90401-90405 -23.2% 0.4 Santa Monica combined

90064 28.9% 0.3 Rancho Park/Cheviot Hills

90505 0.0% 0.3 Torrance

90254 1.4% 0.3 Hermosa Beach

90266 2.2% 0.3 Manhattan Beach

90277-90278 12.0% 0.3 Redondo Beach combined

beach cities 5.1% 0.3 4 Beach Cities combined

90277 23.4% 0.1 Redondo Beach (south)

90275 -3.4% 0.1 Palos Verdes Estates

Our regional real estate $$$ tracker is here.

The Google map interactive version of the regional real estate $$$ tracker is here.