The tone of this article (requires login or $$$), is one of reluctance to admit there is a problem.

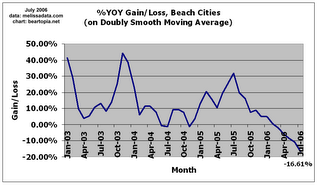

Realtors are still claiming that potential buyers sitting on the sidelines waiting for a big price drop will end up disappointed. "It's just not in the tea leaves". Everybody's anticipating that sales will "pick up" later this year, once the market absorbs the impact of the Federal Reserve's rate hikes. Low affordability along with the "interest rate situation" are blamed for the "wait and see" attitude of buyers.

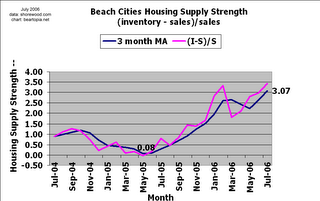

The county median price in July fell to $550,000 from $555,000 in June. (That's just month-to-month.) Median days on market for L.A. County in June is 35.9, compared to 22.4 days in 2005, and, as of June, inventory levels were up to 6.4 months, compared to just over 2 months in 2005.

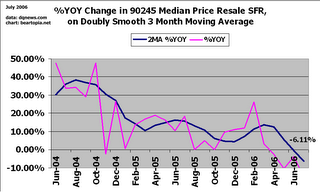

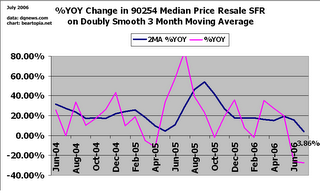

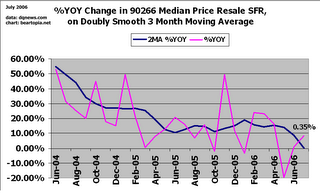

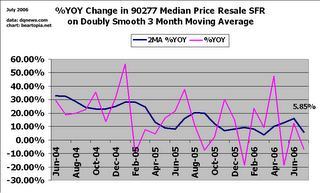

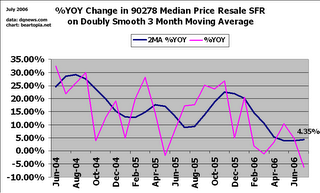

"Nearly every corner of the county saw [July] sales drop by a third or more." The slowdown is hitting hard those communities that saw "healthy" sales volume last year. Redondo Beach was singled out, with July sales volume down 48%. San Pedro's zip codes were down 46% to 50%.

First time buyers are holding back, and those existing homeowners who want to move up are held back by new higher payments and taxes, in spite of sitting on a "mountain of equity".

There seems to be a widening gap between the ultra-rich and the lower-income folks. 37 zip codes have median prices above $1 million, compared to 31 zip codes a year ago. Only 23 zip codes in L.A. County still have median prices $450,000. Prime markets such as Beverly Hills and Malibu are seeing a lot fewer but much pricier sales.

So there you have it, realtors use tea leaves to do their forecasting, and the sales volume we've been seeing the past several years has been "healthy". (Sure, with the interest rate doping that's been going on!) My guess is that the deflationary mentality taking hold will eventually catch up with even the wealthy areas.

This story is so wonderful, though, that I'll reprint the whole thing here:

Posted date: 8/7/2006

Buyers Biding Time as Home Sales Plummet

By DEBORAH CROWE

Los Angeles Business Journal Staff

Los Angeles County’s once soaring housing market continued its descent in July toward

what appears to be a bumpier landing than many had predicted. Sales volume took its

biggest plunge yet this year and the median price dipped back to May’s level.

The number of home sales fell 34 percent to 6,146 – the lowest number for July in at

least three years. The figure was even 15 percent below January, typically a slow

month due to the holidays, according to data provided to the Business Journal by

HomeData Corp., a Melville, N.Y. company that tracks housing prices nationwide.

At the same time, the countywide median price of homes that sold – though 6.8 percent

higher than a year ago – fell to $550,000 from $555,000 in June. Real estate agents

say rising interest rates and lackluster appreciation not only are making prospective

buyers cautious, but many now appear to be holding out for bargains, anticipating

that nervous sellers may be ready to slash asking prices.

“Nobody wants to make a wrong decision,” said Syd Leibovitch, president of Rodeo

Realty’s Paramount Properties Division. “But while the market is flattening, it’s

certainly not going down.”

Some real estate professionals anticipate sales will pick up later in the year, once

the mortgage market absorbs the impact of successive Federal Reserve rate hikes, and

if buyers on the sidelines come to believe that homes are unlikely to see the

depreciations of the 1990s recession.

Of course, July’s price drop from the previous month could be temporary – such dips

in the median price have been seen at least twice in the last 12 months. However,

other data suggest the slowdown may not relent.

Slowdown Spreads

Until July, monthly sales volume this year had ranged 17 to 24 percent lower than

2005’s historic levels. But compared to earlier months with scattered pockets of

sales declines, parts of nearly every corner of the county saw sales drop by a third

or more.

Even one of the county’s most desirable suburbs, Calabasas, saw July sales drop 67

percent to 22 homes, with the median price down 7 percent to $1.2 million. Longtime

Calabasas Realtor Heidi Adams, who had open houses at two $1 million-plus homes on

the last Sunday of the month, said interest rate worries and decreased affordability

have amplified her area’s chronically tight inventory to depress sales volume.

Adams, a Coldwell Banker Realtors agent, said a tougher sales market elsewhere in the

county also is having an impact. Most of her buyers come from the East San Fernando

Valley or the Westside, and when it becomes harder to sell their current home in a

more competitive market, it complicates a new purchase in her city.

At the other end of the transaction, Adams increasingly has serious talks with

clients who have unrealistic expectations about what their properties can sell for in

this market.

“If the house is really emotional, with a great yard and a great view, it will sell

for the asking price in 30 days,” she said. “But for some properties I give it 30

days – 45 tops – and then I say, ‘Guys, you’ve got to get real.’ ”

The California Association of Realtors estimates that as of June, homes in L.A.

County were staying on the market a median 35.9 days, compared to 22.4 days a year

ago. That has had the effect of building up inventory levels to 6.4 months in the

county in June, compared to just over two months a year ago. Six months is generally

considered a balanced market for both buyers and sellers.

The slowdown appears especially acute in communities that saw healthy sales volume

last year. In the north end of the county, July sales were down 80 percent in Newhall

from a year ago, 77 percent in Santa Clarita’s 91390 ZIP code, and 40 percent in

Palmdale’s 93550 ZIP code.

In the East San Fernando Valley, Studio City was down 52 percent and Van Nuys’ 91401

ZIP code 65 percent. On the Westside, Brentwood was down 72 percent and West L.A. 62

percent.

Sales in five of Long Beach’s 11 ZIPs were down more than 50 percent. Redondo Beach’s

90278 ZIP code was off nearly 48 percent. San Pedro ZIP codes were down 46 to 50

percent.

Continued low affordability, along with the interest rate situation, are feeding a

wait-and-see attitude, said Steven Thomas, president of Re/Max Real Estate Service’s

Southern California operations. The national average on a 30-year fixed-rate mortgage

stood at 6.72 percent at the end of July, compared to 5.7 percent a year earlier.

That hasn’t helped a growing affordability problem that at the end of 2005 saw only

14 percent of households in the county able to buy a median price home of $529,000,

according to the state Realtor’s association.

“First-time homebuyers may sit on the sidelines waiting for that big price drop, but

that’s just not in the tea leaves with the supply and demand situation here,” Thomas

said. “Homeowners looking to move up are in a different situation. They may be

sitting on a mountain of equity, but what’s holding them back is the realization that

their new payments, and taxes, are going to be higher.”

High End Rises, Low End Shrinks

Indeed, 37 ZIP codes in the county now have median prices above $1 million, compared

to 31 a year ago. At the low end of the market only 23 of the 268 ZIP codes in the

county still have medians less than $450,000, generally either in the inner city or

the rural north, such as $420,000 in Watts’ 90002 and $336,000 in Palmdale’s 93550.

And in prime markets, prices seem to have their own logic. In Beverly Hills, fewer

but pricier closings catapulted the iconic 90210 ZIP code to a median of $2.85

million, a 76 percent increase and the county’s highest median. The 10 homes sold

were 63 percent fewer than a year ago.

Same story in Malibu, where the nine homes sold represented a 74 percent drop in

volume but a 24 percent jump in median price to $2.2 million.

Still, fewer sales don’t always translate into higher prices. Los Feliz’s trendy

90027 ZIP fell out of the million-dollar club last month, with its median falling 24

percent to $895,000 on 19 sales, 37 percent fewer than a year ago.

“At the high end, most people have holding power,” said Rodeo’s Leibovitch. “They’re

not desperate. People may read that the bottom’s fallen out of the market and make

offers that are really low, but then they don’t get the house.”