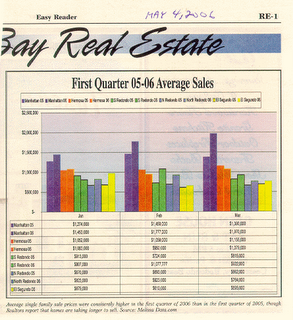

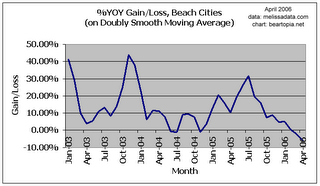

A quick glance at sales numbers for the beach cities, so far for May, show Hermosa Beach (90254), south Redondo Beach (90277), and north Redondo (90278) apparently resuming their slump over last year's numbers, while Manhattan Beach (90266) and El Segundo (90245) appear to be hanging on, but not exactly powering above the number of sales last year either. We'll continue to watch and see if that late winter/early spring bounce is over.

I thought I would track down some homes I had mentioned earlier this year that were for sale, and see what has happened to them.

2002 Noslen Lane

I was mistaken about the front unit being for sale, it was actually the rear unit. It was listed for $999,900 and sold in February 2006 for $990,000. Zillow estimates its current worth at about $1,102,634, within the range $959,292 - $1,201,871.

I was mistaken about the front unit being for sale, it was actually the rear unit. It was listed for $999,900 and sold in February 2006 for $990,000. Zillow estimates its current worth at about $1,102,634, within the range $959,292 - $1,201,871.

2102 Swehtam

Don't let ZipRealty fool you. The listing date for this property is currently 4/24/2006, but in reality it's been for sale at least since New Year's. Last winter the sales brochure said "only $995,900", and now according to Zip Realty it's being offered at - whoa! - $889,000!! That's a better than 10% markdown! The real days on market is probably 120 and counting.

Don't let ZipRealty fool you. The listing date for this property is currently 4/24/2006, but in reality it's been for sale at least since New Year's. Last winter the sales brochure said "only $995,900", and now according to Zip Realty it's being offered at - whoa! - $889,000!! That's a better than 10% markdown! The real days on market is probably 120 and counting.

3191 Setag

As far as I can tell, this house did not sell.

As far as I can tell, this house did not sell.

The asking price was $1,198,000.

0212 Ruofud #19 and #20

#19 finally sold in March for $579,000. I don't think #20 was so lucky, even after getting listed with a second realtor at $570,000. I think the owners are now trying to rent out the unit. #2 in that same complex is now also for sale, at $589,000. Didn't the #2 realtor take note of what's happened with #19 and #20?!?

5122 Ruofud

This one is a mystery. A little old post-war box house, originally listed October 2005, I believe, at $950,000, then reduced to $900,000. It appeared the listing expired and there was no SOLD sign hung out in front. However it is now being torn down for condos. Was this some kind of private sale - a foreclosure - what?!? This is what makes following up on these properties so difficult - inconsistent data available through the regular channels.

This one is a mystery. A little old post-war box house, originally listed October 2005, I believe, at $950,000, then reduced to $900,000. It appeared the listing expired and there was no SOLD sign hung out in front. However it is now being torn down for condos. Was this some kind of private sale - a foreclosure - what?!? This is what makes following up on these properties so difficult - inconsistent data available through the regular channels.

0025 Nosnibor

This craftsman style home has been on the market at least since October 26, 2005 and was originally listed at $1,290,000. It has been relisted a few times, the last date being 4/18/2006, with the current asking price $1,225,000. Big deal.

This craftsman style home has been on the market at least since October 26, 2005 and was originally listed at $1,290,000. It has been relisted a few times, the last date being 4/18/2006, with the current asking price $1,225,000. Big deal.

3391 Swehtam

Unit B was advertised in February for $889,000. After a relisting (with price reduction), the asking price is now $849,900. The Zillow data looks like it got messed up somehow, as I had better data on this complex in February, but now it looks like the data in Zillow describes the old house previously standing there prior to these new condos.

Unit B was advertised in February for $889,000. After a relisting (with price reduction), the asking price is now $849,900. The Zillow data looks like it got messed up somehow, as I had better data on this complex in February, but now it looks like the data in Zillow describes the old house previously standing there prior to these new condos.

These are just a few of the properties I've been observing, and as you can see it's a mixed bag. Some listings sell, some expire with no sale, and some relist at lower prices. Right now I am seeing a few "In Escrow" signs hung up around the neighborhood, so some homeowners are succeeding in selling their homes and hopefully getting out of the bubble.

I was mistaken about the front unit being for sale, it was actually the rear unit. It was listed for $999,900 and sold in February 2006 for $990,000. Zillow estimates its current worth at about $1,102,634, within the range $959,292 - $1,201,871.

I was mistaken about the front unit being for sale, it was actually the rear unit. It was listed for $999,900 and sold in February 2006 for $990,000. Zillow estimates its current worth at about $1,102,634, within the range $959,292 - $1,201,871. Don't let ZipRealty fool you. The listing date for this property is currently 4/24/2006, but in reality it's been for sale at least since New Year's. Last winter the sales brochure said "only $995,900", and now according to Zip Realty it's being offered at - whoa! - $889,000!! That's a better than 10% markdown! The real days on market is probably 120 and counting.

Don't let ZipRealty fool you. The listing date for this property is currently 4/24/2006, but in reality it's been for sale at least since New Year's. Last winter the sales brochure said "only $995,900", and now according to Zip Realty it's being offered at - whoa! - $889,000!! That's a better than 10% markdown! The real days on market is probably 120 and counting. As far as I can tell, this house did not sell.

As far as I can tell, this house did not sell. This one is a mystery. A little old post-war box house, originally listed October 2005, I believe, at $950,000, then reduced to $900,000. It appeared the listing expired and there was no SOLD sign hung out in front. However it is now being torn down for condos. Was this some kind of private sale - a foreclosure - what?!? This is what makes following up on these properties so difficult - inconsistent data available through the regular channels.

This one is a mystery. A little old post-war box house, originally listed October 2005, I believe, at $950,000, then reduced to $900,000. It appeared the listing expired and there was no SOLD sign hung out in front. However it is now being torn down for condos. Was this some kind of private sale - a foreclosure - what?!? This is what makes following up on these properties so difficult - inconsistent data available through the regular channels. This craftsman style home has been on the market at least since October 26, 2005 and was originally listed at $1,290,000. It has been relisted a few times, the last date being 4/18/2006, with the current asking price $1,225,000. Big deal.

This craftsman style home has been on the market at least since October 26, 2005 and was originally listed at $1,290,000. It has been relisted a few times, the last date being 4/18/2006, with the current asking price $1,225,000. Big deal.